Insurance Graph + AI Enablement

- Blog >

- Insurance Graph + AI Enablement

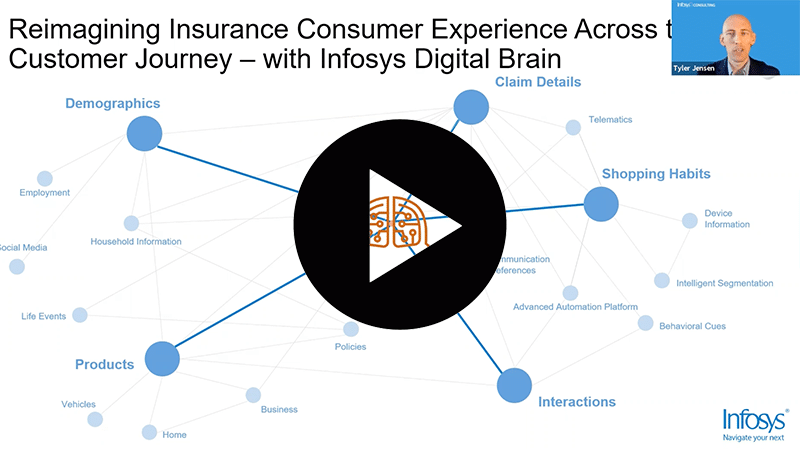

This is an abbreviated version of a presentation by Tyler Jensen, Senior Consultant at Infosys Consulting, during the Fall 2021 Graph + AI Fall Summit conference.

I’ll begin my presentation by admitting that knowledge graphs don’t get the publicity or glamour of the popular insurance industry trends like self-driving vehicles and technology there. So, you’ll have to hear from me instead of Elon Musk — my name is Tyler Jensen and I’m with Infosys consulting.

My presentation is about graph technology, and how the insurance industry is utilizing AI and ML capabilities in connection with those graphs. It’s an exciting time because these technologies are only just beginning to be adopted by the insurance industry.

Insurance organizations are struggling to distinguish themselves among the industry that’s highly competitive and is often seen as a commodity by customers, particularly when it comes to claims that can be the differentiator to establish the product to real value for the consumer.

It’s no secret that insurers have a huge amount of data available to them. If you think about it, they’ve been operating for sometimes hundreds of years in an industry that has an entire discipline devoted to the study and application of data and numbers, which is actuarial science. But when you look at the percent of data that’s actually used, it’s barely scratching the surface. A recent Forbes article stated most insurance companies don’t use a lot of data to create their products. Instead, they rely on demographic information that is 40 years old and older.

Organizations can rethink their offerings and customer experiences using artificial intelligence and machine learning, and graph technology at all levels of the journey.

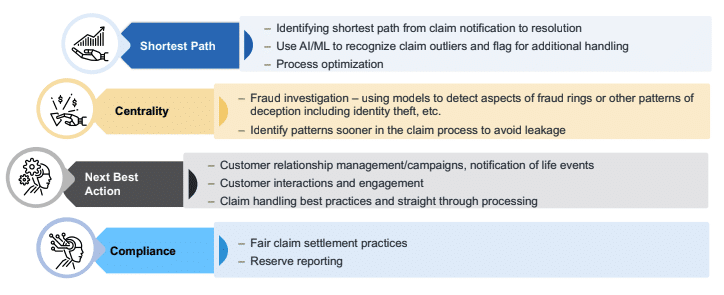

Graph technology can help in many areas. One of these is utilizing graph technology to improve internal claim handling. This new technology would enable faster, broader searches for data to identify potential fraudulent activity on a claim. Graph enables data-driven decisions and consistency and claim handling. One primary outcome of this effort is a projected reduction in claim cycle time and improved claim payment accuracy.

One of the common algorithms used in graphs is a shortest path search. How does this help with insurance claims? Each claim has a life cycle that starts when the accident happens with a first notice of loss to the insurance company and ends with the final claim settlement. Now, if you talk with the claim handler who’s done this for more than just a couple days, you’ll find out that the claim often follows predictable paths. Not always but mostly. And you’ll find that sometimes the path may lead to a negative experience for the customer; as they say, a large gaze swings on a small hinge. If these hinge points can be identified earlier and resolved, they can lead to a better customer outcome.

Sometimes those claims are the ones that require the most attention as quickly as possible to redirect or handle in another way. Machine learning can identify those paths that are otherwise not really noticed by individuals and bring them to the forefront to address as a claim handler; how would you like to see a notification that a particular claim requires immediate attention to avoid lengthy resolution steps down the road?

Another example of where machine learning can help is with identifying fake damage photos. ML can identify the content of those photos and search previous claims, as well as the internet, to find similar pictures. One fraudster recently tried to crop a photo from the internet of a fire-damaged kitchen and use that for evidence of loss. Luckily, it was identified and stopped before payment was made.

A combination of graph and AI and ML has the potential to save vast sums of money. And, even if the amount of money saved per claim is small, it’s a significant amount when multiplied by 1000s of claims. This is an eye-opening prospect for many of us in the insurance industry.

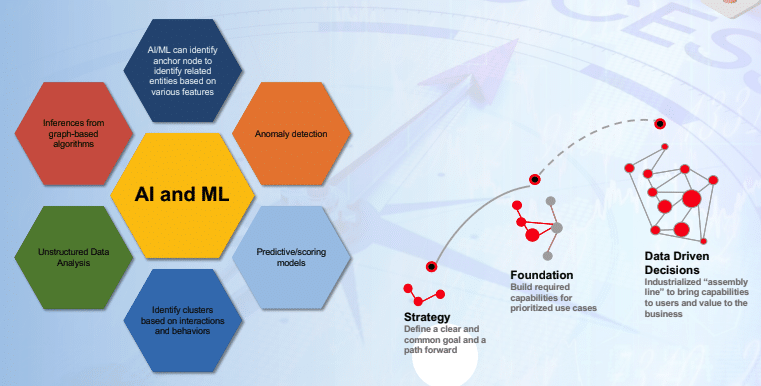

This is an example of some of the data points that can be utilized with AI and ML within a graph. There are so many data points that can be brought in. It requires data scientists to rely on these additional computer resources to determine even where to focus their efforts. But certainly, there are aspects of a customer journey from their demographics and purchasing preferences to their interactions with an organization that is primed for integration with AI and ML. Each of these areas can be leveraged to build a 360-degree customer view. And then reimagine the customer experience based on that knowledge, graphs are easy to expand and connect.

Some of the additional use cases we have seen in the industry are listed here. From inferencing and predictive models to analyzing unstructured data, like photos, videos, and verbal communication, AI and ML can be utilized with underlying graph technology to enhance operations. Insurers can apply this technology in various aspects of their business to improve customer service and reduce costs. In order to achieve this success, organizations need to define a clear and common goal or path forward. They will then build the required capabilities using graph technology based on prioritized use cases.

The value of knowledge graphs is in making data-driven decisions to support operations. Again, it’s a step-by-step step process. We’ve come a long way in the industry from simply identifying which houses have trees in front of them, and which risks to accept. Now, insurers have so much data, it’s almost humanly impossible to determine how to utilize that. Fortunately, there is AI / ML that can take on that burden, formulate insights, and enable companies to utilize graph technology to differentiate themselves from the competition.

This is an exciting time to be involved with graph technology. The question is, how are you going to adopt graph plus AI and ML to make your insurance business more productive, effective, and customer-focused?

I wish you the best in your efforts and would love to assist where needed.

Graph + AI Summit Spring 2022

Registration is open for Graph + AI Summit Spring 2022, being held virtually May 24-25, 2022. Join us once again as we present the industry’s only open conference dedicated to accelerating analytics, AI, and machine learning projects with graph algorithms.