Looking Back on Graph + AI Spring & Save the Date for Graph + AI Fall

- Blog >

- Looking Back on Graph + AI Spring & Save the Date for Graph + AI Fall

A month ago we hosted Graph + AI Summit Spring 2021.

With over 40+ sessions ranging between tracks that focused on:

- Banking, Insurance, and Fintech

- Healthcare, Life Sciences, and Government

- Graph + AI in the Cloud

- Combining NLP with Graph for Analytics and AI

- Enterprise Ecosystem for Graph + AI

- Visualization of Connected Data for Analytics and AI

- Data Science with Graph Algorithms and Machine Learning

There was certainly no shortage of content explaining the many ways graph is being adopted and how it is accelerating AI projects.

My personal favorite quote from the event was from Dr. Nikhil Deshpande – Director of Product Development at Intel during his session Hardware Considerations for Faster and Deeper Insights from your Large Scale Graph:

“The world is going to be graphs moving forward, because that is fundamentally what we are, that is what the ecosystem is…graph is going to give us the insights we don’t have today.”

Our ecosystem is all connected and that is why graph analytics makes logical sense to further data analytics and AI projects. Here are some other great moments from the event that further this notion.

- “When we started building our relational database, we built it with questions in mind, but the problem with research is that you never really know what the perfect question is in the beginning. With a graph database, it’s possible to answer random questions, which is typical for us as a hospital or doctor comes up with a new question and expects the answer to be somewhere in the data.”

- “The graph database is dynamically extendable to accommodate new sources of information so we do not have to redefine the database every time we add new data sources.”

- “We are still using traditional databases, but graph provides us with the ability to learn about connections. This is why we ended up with a graph database.”

- “We would like to use our current technology and build on top of it. We are utilizing Snowflake and our SQL systems and bolt on [TigerGraph] to make our lives easier and provide much better insights.”

Brad Spiers, Executive Director, JPMorgan Chase – Graph + AI Summit Opening Keynote

- “Graphs clarify relationships. You can turn an initial hairball (of data and connections) into nuanced insights like which portions of my graph whether it’s your supply chain, customers etc. are low risk or high risk. Then machine learning can leverage those nuanced insights, turn those more nuanced inputs into better models.”

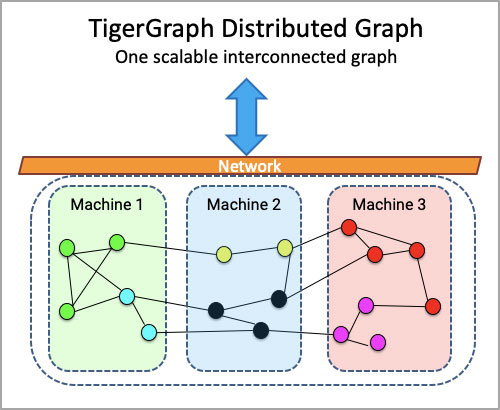

- “Graph algorithms scale exponentially. Graph requires scalable software, more so than any of the other situations or challenges you have considered.”

Danny Clark, Head of Fraud Strategy, NewDay – Graph + AI Summit Day 2 – April 22, 2021 Keynote

- “As we’re generating upwards of 10 million of (card) transactions/month, (finding fraud) it’s like looking for a needle in a haystack.“

- “Initial rollout of TigerGraph Cloud has reduced the undetected fraud cases by 10%-15% and we are planning additional enhancements in fraud detection and rollouts in other areas of the business.”

- “Algorithms get all the praise, it’s all about data that leads to AI success!”

- “ML can predict customers who are likely to churn. Graph and AI can determine the best way to retain customers and improve customer experience. Graph makes AI better.”

“People are really realizing the value of graph. About 40% of enterprises are doing graph projects currently, and that number will double in the next 5 years”

Uri Lapidot, Sr. Product Manager, Intuit – Using Graph to Boost AI – How Intuit Doubles the Performance of Fraud Detection:

- “Using graph-based (machine learning) features, our model shows an amazing improvement in detecting 50% more risk events (fraud) and also improving model precision by 50% (false positives) at the same time.“

- “For us, this is a game-changing technology that we intend to leverage more and more in the future.”

Danny Clark, Head of Fraud Strategy, NewDay – Keynote

- “As we’re generating upwards of 10 million of (card) transactions/month, (finding fraud) it’s like looking for a needle in a haystack.“

- “Initial rollout of TigerGraph Cloud has reduced the undetected fraud cases by 10%-15% and we are planning additional enhancements in fraud detection and rollouts in other areas of the business.”

Farley Mesko, CEO, Sayari Labs – Open Data and Graph Analytics for Risk Management and Compliance

- “Graphs are great for AML (Anti-Money Laundering) & KYC (Know Your Customer) as they are purpose-built for answering questions about connectivity between entities. This is especially useful when complying with AML & KYC regulations and establishing a company’s ultimate beneficial owner (UBO), as hierarchies can often run up to 10 levels deep.”

- “We can use analytics to look at risk factors within the network of relationships, and transactions between people and companies—and then use graph technologies to examine risks that we may not have been able to see before.”

“TigerGraph reached up to 1.5 million created nodes per second, while for Neo4j that number stopped at 22,000 nodes per second and degraded over time.”

“We have a 2-hop query and we have a 4-hop query. With the number of hops increasing, TigerGraph performs better than Neo4j. With our medium graph (82.7 million vertices/business objects, 218 million relationships), TigerGraph finishes the 4-hop query (for the entire dataset) in 30 minutes, with Neo4j we could not get the 4-hop query done. After 10-hours of the experiment, we just terminated the experiment short with Neo4j.”

Looking back on last month’s event we are so grateful for the graph community and looking forward to our next Graph + AI Event October 4-6 (tentatively). Save the date!