Customer 360 for the Banking Industry

- Blog >

- Customer 360 for the Banking Industry

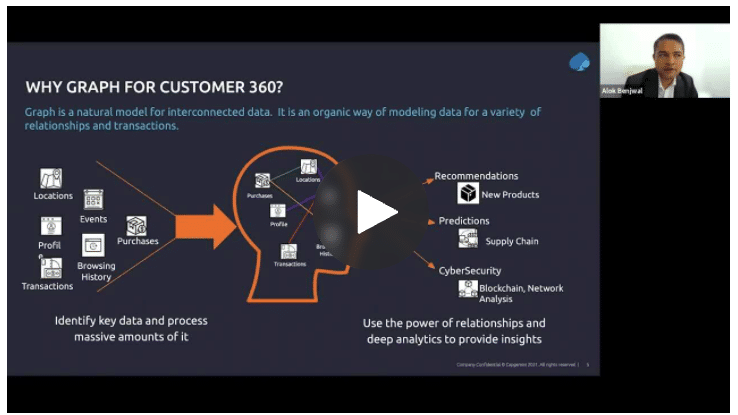

This is an abbreviated version of a presentation by Deepak Juneja, Vice President – Head of Global Data Management at Capgemini, and Alok Benjwal, Vice President at Capgemini, during the Fall 2021 Graph + AI Fall Summit conference.

Watch the full session from Graph + AI Summit Fall

Better Banking and Insurance Experiences

In today’s session, we’ll talk about how customer 360 is enabling the banking and insurance industries to provide better client experiences and lifelong engagement. We’ve been working with multiple clients in investment banking and property and casualty insurance, and we’ll share some of the trends we’re seeing with them.

So, let’s introduce ourselves before getting started on this interesting topic:

- I’m Deepak Juneja, responsible for data management and data fabric capability for Capgemini, Financial Services Globally, where we work with the clients to help with the solution definition, operationalize and implement it. Alok has joined me today to cover this session.

- I’m Alok Bejwal, Vice President of Banking Analytics here at Capgemini. I have 20 plus years of experience, working with major FIS like Citi, JP Morgan Chase, Lincoln Financial, and across my career, I’ve seen customer 360 growing. It is a very important subject within the banks, and I think it also augments customer experience. I’m really looking forward to the discussion. Back to you, Deepak.

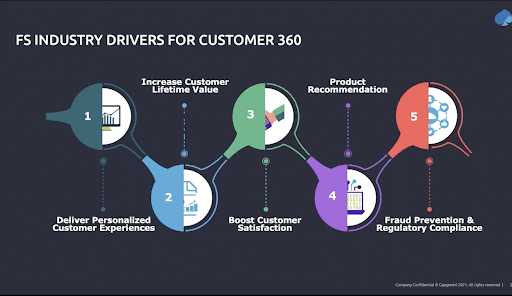

Before we start diving into how we have seen customer 360 providing value and how our clients have been leveraging them, let’s start with some of the key drivers. As we have seen in the last few years, customer interaction through the digital channel has tremendously increased, driven also by the pandemic.

Figure 1: Financial services industry drivers for customer 360

All these increased interactions are driving the need for all our banking and insurance clients to deliver a more personalized customer experience, which means we should be able to offer them the right experience and help them better improve their relationship with their clients. That’s why boosting customer satisfaction becomes a very key driver. It’s also important to identify the right product they should recommend at the right time and when there is a need for that product.

This will actually drive an overall increase in customer lifetime value because, at the end of the day, it’s not about just selling services, but making sure there’s a value that clients are achieving through the product they’re offered. The banking and insurance industry needs to make sure they’re complying with regulations. They need to make sure when they are onboarding new products or having interaction and activities, they make sure they have good control on checking the fraud, interaction, or any of the required activities.

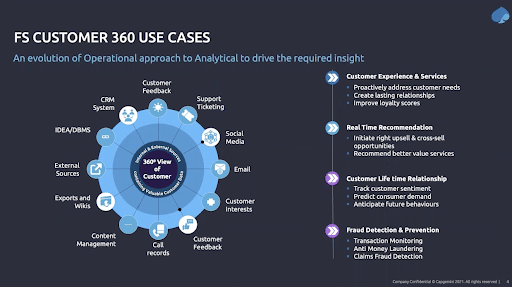

Next, we have been working with the client, providing them operational capability around master data management for the customer. Now, the demand is moving from operational activities to more analytical, where they can get better insights about the customer, their desires, their demands, and their requirements.

Figure 2: Financial services customer 360 use cases

Bringing Customer Info Together with Customer 360

Customer 360 brings together all the relevant information about a customer, whether internal within the organization or external. You can detect what their desires are, what are their future lifetime events, how they can use the services the best, what could be the new services we should offer, or bring in some refined and revised personalized offers for them.

We want to make sure we’re providing real-time recommendations on the product and services they are looking for. It’s always easy to upsell and cross-sell new products and services compared to bringing in a new client. It becomes critical to provide use cases and support the use cases regarding transaction monitoring, anti-money laundering, and also in the insurance industry, about the claims and fraud detection. These are some of the key use cases which we are seeing for financial services clients and it continues to grow, and we are looking for graph as a technology to help support some of those because of the value it can bring.

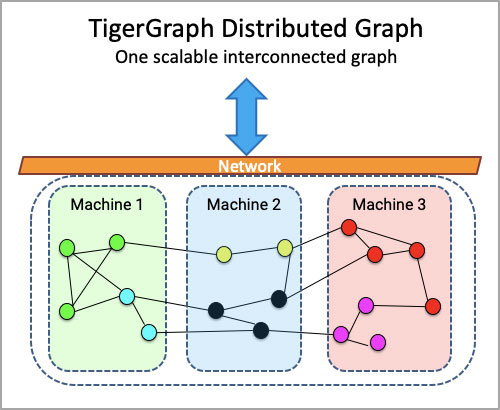

I think if we take it back to the graph discussion, this becomes a huge data problem because what we’re talking about here is data coming at a speed, which could be in real-time or near real-time. It could be data coming from different aspects of the customer lifecycle, all the way from marketing, to customer onboarding, to even you know, lifecycle management and spend. When you bring all this data together in one place, just to query that data and get meaningful insights out of it, it becomes a huge task. I think something like graph databases can really augment some of the use cases that we see.

The financial service industry is very regulated. You need to make sure the data is accurate, and we’re talking about trying to build this concept, which has really formalized over the years, the concept of data as a shared asset. Data does not belong to marketing, or to finance, or to operations — it’s the same data that is shared across functions, and then it’s the data about the same individual or the customer. The data doesn’t really need to be just accurate, it needs to be the same version of truth, across functions across touchpoints, and the customer should feel that they are being recognized when they go from one touchpoint to another across channels, or across functional touchpoints.

Oftentimes you think, apply the 80/20 rule: 20% of your data gets you 80% of the insight so that’s why you have the querying capability. Being able to traverse through this complex data ecosystem becomes very important. Things like a graph database are definitely going to help with that in separating that signal from the noise. And last, but not least, we are in the financial services industry and everything needs to be compliant. There are so many privacy laws that have come up in the last, three or four years.

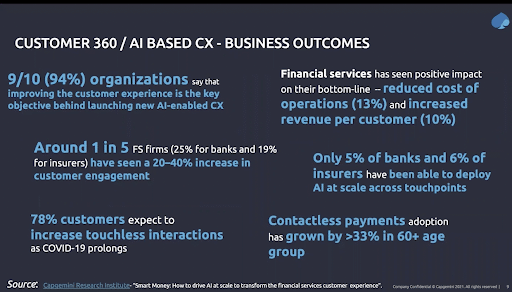

Figure 3: Customer 360 / AI-based CX-business outcomes

Customer 360 and AI-based customer experience are becoming increasingly important in the banking and the financial services space. Over the last two to five years, companies have come to realize that if they really want to compete, they cannot be just one product and pricing. There has to be customer experience, stickiness, engagement, and all those good things that we’ve talked about in this session.

So, to conclude, all the banking and insurance clients see their key business priority is to provide clients as a first experience and give them a full comprehensive experience across all channels. What we see working with some of the key clients, which we are engaged with today, and we have helped them implement some of the customer 360 using graph technology and more as the overall paradigm, has helped them to achieve their goals faster, quicker, and more comprehensively.

We see this being your value all our clients can leverage, and take that to the next level of the digital transformation journey, and supporting client-first thinking. Thanks for joining us today. We had a good time covering some of the key points and look forward to future interaction on this topic.

Spring 2022 Graph + AI Summit

The Spring 2022 Graph + AI Summit is right around the corner! This global virtual conference will bring together our community to advance graph analytics, artificial intelligence, and machine learning knowledge.

Conference details and registration information will be available here soon.