The Future of AI and Machine Learning in Fraud Detection

- Blog >

- The Future of AI and Machine Learning in Fraud Detection

This transcript is edited from the TigerGraph Connections podcast published on September 12, 2022, with TigerGraph’s Sebastian Aldeco.

Corey Tomlinson: Tumultuous times lead inevitably and unfortunately to fraud, especially for large companies handling their clients’ financial means. After all, that is where the money is, making those institutions prime targets for fraudulent actors. Fraud, specifically how machine learning and AI can be used to combat it is the topic of this episode of this podcast.

Sebastian Aldeco, Director of Financial Services Industry Solutions at TigerGraph, is our guest. Sebastian, can you tell us a little about your background and your role at TigerGraph?

Sebastian Aldeco: For the last fifteen years, I have been a part of the crime, fraud, risk, and compliance solutions offerings from the vendor side, initially in technology roles as a chief technology officer for Asia-Pacific for a company that was an identity verification and risk detection provider.

Now that I’m based in Singapore I am involved in all the areas of financial crime and financial solutions. So, ensuring that we have the best technology to detect all the possible scenarios. That is my primary role at TigerGraph, ensuring that the financial services have all the solutions and showing them how graph can massively improve the level of detection that they have with the products.

Corey: What are some of the hurdles that financial services companies face when it comes to fighting fraud?

Sebastian: Usually, the main problem that financial services face is the fact that the data is not in the same place. A lot of companies have different silos of information covering different places. That is because a lot of them have grown massively really quickly and they just brought different solutions to cover different needs. It could be through acquisitions – they acquire another financial institution, and they absorb the technology, so they have a customer base in one system and another customer base in another system.

This forces them when they need to do a check-in of customer activity, all the data is spread all over the place, and they take a lot of time to put it all together when they actually try to detect fraud. What they do is they have a lot of different products for different systems, so they have a product for critical detection. They have a product for application of fraud. They have a product for insurers. All these products tend not to talk with each other. So what happens is they lose the ability to cross-check the information on different platforms, and usually that tends to be the major problem that they face through implementation and through a technology point of view.

Corey: There’s the recent pandemic, we have war in Europe, and a potential recession. How do you see this amalgamation of worldwide events affecting the financial sector? Specifically is it a driver for fraud to happen?

Sebastian: Every crisis that has happened in the world has driven fraud to scale up. People may lose their job. They may lose their income. They may have different challenges, and they become victims. They may have a gambling problem. It’s not always bad people; it could be people in trouble.

Other individuals actually found that this is a way to make a living, so a crisis gives them more opportunity to target desperate people. We had the sub-prime crisis in the US several years ago … the COVID pandemic increased the types of fraud because people were at their homes and a lot of people didn’t actually have a source of income. Then the war in Europe also triggered an amount of fraud, and particularly money laundering, through the sanctions that the Russian citizens received. You now have the recession in the US.

Every time that you have one of these activities, fraud spikes and it’s a natural reaction to the desperation that the people get into because they really don’t know what to do and some of them are left on the street, so there is a direct correlation between those two things.

Corey: Getting to the conversation we wanted to have about the future of AI and machine learning in fraud detection. These terms are often misunderstood, and they are very commonly referenced, to the point of being buzzwords.

This is a two-part question. Can you talk a bit about the reality of machine learning technologies, especially graph-based capabilities, and how AI and machine learning help these companies that we’re talking about more efficiently detect fraud today?

Sebastian: I spend a lot of time in my work defining what is science fiction between AI and what real capabilities are with machine learning. AI was promoted as the solution to all your problems, and that was an obvious exaggeration at the time.

Ten or 15 years ago the way to fight fraud was through business rules. You were attacked by a particular fraud scenario, and you created a business rule to ensure you were protected from this potential fraud in the future. That generated a lot of communication between entities because the type of fraud that happened in Africa later moved to happen in Europe and later moved to happen in the US. The financial institutions were sharing information; it worked at the time, but it was a really reactive approach. You needed to be attacked first in order to find out what happened and then create a rule. The crime syndicates, however, are very creative people and they manage their business to find new ways around these rules.

This makes the situation not optimal because you are not ready for the new thing that is coming. When machine learning was introduced the whole idea of machine learning is that machine learning models will predict potential new fraud; it came to compensate for the lack of predictiveness that business rules had. Obviously, there was a different level of accuracy, and there was social evolution in the machine learning models now we clearly know which machine learning models are better than other ones. A few years ago we had a lot of data scientists applying what they knew in the university, but right now we have reached a peak in the performance that machine learning can do with traditional solutions. So that is when a company like TigerGraph comes to provide more power to those models and be more efficient when they predict new types of fraud.

Corey: Talking about fraud detection, what is the number one challenge with those types of products?

Sebastian: Early on, the challenge was the capacity for data storage was really rigid. Now you have the data distributed in different places; volumes in those times were much less than now. Transaction volumes have now massively increased. With COVID, in particular, volumes drastically increased with people stuck in the house. Everything they used to do in cash or on credit cards now moved to the online space.

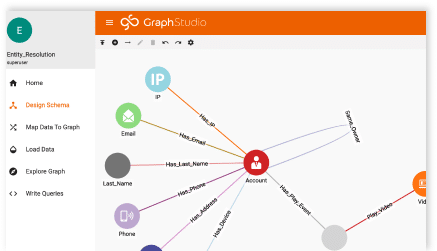

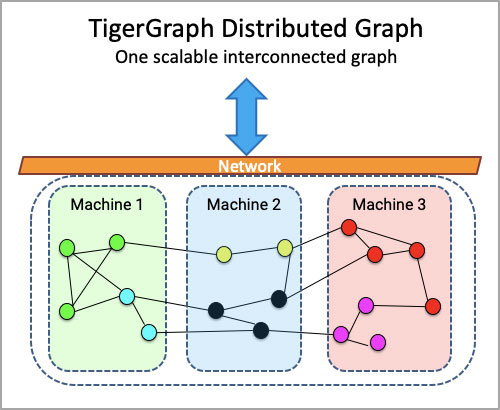

That’s led to quite a boom of digital information; what happened is relational databases also have a limit on the data they can put together. One of the things TigerGraph resolves is the way that the data is stored; all the data and all the entities are connected to each other. So once you need to create a relationship between different entities – for example, you are following a money trail, or you are following dirty money moving from one account to another account to another account to another account – you want to find all the players in this money trail movement.

With a relational database, due to the volume of data that you need to evaluate and the amount of hops that you need to do from entity to entity, you don’t have the power to do it, because every time you need to go through massive amounts of data. When you have a product like TigerGraph, all these entities, links, and relationships are already stored. The graph schema allows you to see all the data users need to run a query.

That’s why a product like TigerGraph introduces more power to your machine learning models. It gives you more capability to deliver a more efficient result and also allows you to be more predictive, and in that sense having TigerGraph helps you break that cycle of not being able to provide more efficiency to your model because your model is limited only by the data that you can provide it. If you are able to provide more data to the model, you have more options to make it more powerful, and that is why essentially we have the next level of technology and the next level of implementation power, to try to make your platform much much better and much more productive.

Corey: Looking forward a little bit. You know technology is moving at such a fast pace. AI and machine learning are no different. What does the future hold for AI and machine learning in the fraud space?

Sebastian: There will be new and better models. There’s going to be more integration and interaction. More data silos will be broken.

In order to cover the challenge that we mentioned before about the financial institutions having different systems and those not talking to each other, the whole idea of that one is you need integration. Take your credit card product. You have blocked an IP address in your payment product. A platform like TigerGraph will allow you to unify all the data on the same platform.

Because you unify everything on the same platform with graph capabilities, you can create relationships between them so you will be able to find out that the IP address that you block on the credit card system is connected to a device that is connected to an account of another person. In that sense, you will be able to do a massive backwash of your whole database between all your entities and between all your products and find that, for example, there is a potential fraud syndicate attacking me right now.

With the evolution of fraud detection, instead of just checking the individual transaction and asking “Is this a good or a bad transaction?” you can ask “Is it related to a potential criminal activity? Let’s find out.” Let’s find out the links, and when you look for the links, then you can identify something much bigger.