JP Morgan Chase Saves $50M By Transforming Fraud Detection with Real-Time Graph Analytics

The Challenge

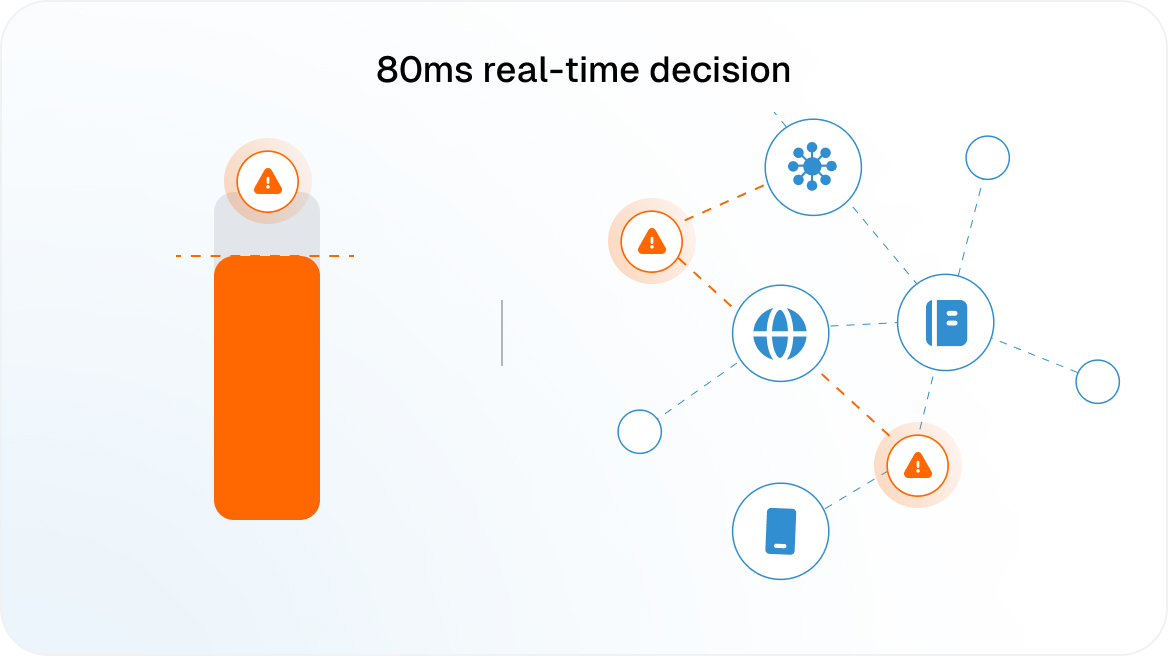

Existing fraud detection methods missed complex patterns, costing hundreds of millions annually. Legacy systems struggled with accuracy and couldn’t scale to handle 50M+ daily transactions under 80ms response time requirements.

The Solution

Implemented TigerGraph’s high- speed graph database to analyze relationships and patterns in real- time. Integrated ML algorithms with graph features to detect synthetic fraud through complex queries and centrality clustering of suspicious accounts.

The Results

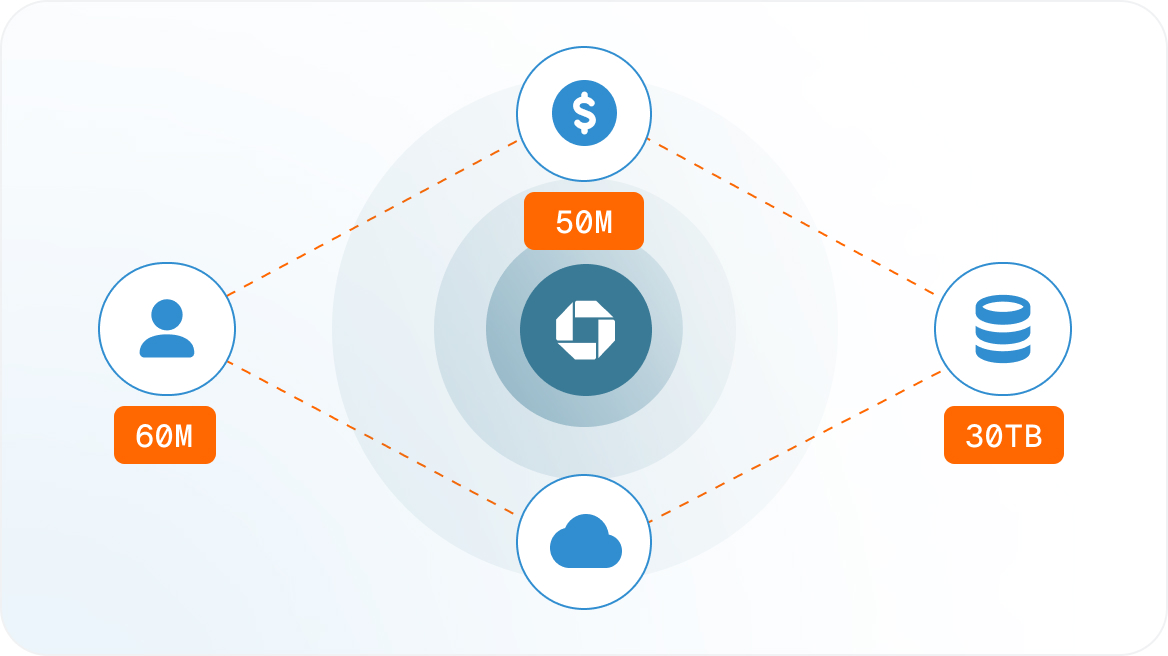

Achieved $50M in operational savings while protecting 60M households. Enhanced fraud detection accuracy with 30TB+ data processing capacity and sub- 80ms response times for real-time transaction analysis.

The Challenge

JP Morgan Chase faced a critical challenge in fraud detection despite having systems that were considered industry-standard. Undetected fraudulent transactions and applications were costing the bank hundreds of millions of dollars annually, highlighting significant gaps in their existing approach. The bank’s legacy fraud detection methods struggled with accuracy and were unable to scale effectively to meet the demands of their massive transaction volume. The core issue was the need to identify transactional and relationship patterns far more complex than what traditional data table analysis could reveal. These patterns needed to be discovered and delivered in under 80 milliseconds to support real-time decision-making for their machine learning inference pipeline. With over 50 million daily transactions from a large, varied customer base generating data points at massive scale, the existing systems were simply inadequate. The legacy approaches were not only difficult to adapt to changing regulations but also fundamentally unable to handle the sophisticated fraud schemes that were evolving in the market.

The Solution

JP Morgan Chase implemented TigerGraph’s advanced graph database technology to revolutionize their fraud detection capabilities through real-time relationship analysis. The solution enabled the bank to more accurately identify fraud by uncovering complex patterns through sophisticated graph queries and algorithms that went far beyond traditional database capabilities. The advanced machine learning training system, running in their private AWS network, integrated machine learning algorithms specifically designed to detect synthetic fraud, utilizing centrality analysis and clustering techniques to identify suspicious account networks. The architecture combines transaction data, account holder information, and merchant data into a comprehensive graph structure that can be updated on a regular basis without interrupting operations. The model was deployed as a real-time streaming pipeline that processes requests for graph patterns and algorithms, characterizing the risk level of each transaction and its associated parties. Results are delivered as numeric vectors for seamless integration into existing machine learning models, which are retrained frequently to adapt to new and evolving fraud patterns. To ensure high availability and fault tolerance across JP Morgan Chase’s geographic range, TigerGraph replicas were deployed across multiple regions, providing the scalability and reliability required for such critical operations.

The Results

The implementation delivered transformative results that exceeded expectations across multiple dimensions of performance and value creation. JP Morgan Chase achieved $50 million in operational savings while simultaneously protecting 60 million households from fraudulent activities. The system successfully processes over 30TB of raw data capacity, demonstrating its ability to handle massive scale operations without compromising performance. The architecture now features high-availability TigerGraph database replicas, regularly scheduled machine learning model training that combines graph features with traditional data features, and real-time streaming ML inference pipelines for fraud prediction. Multiple high-speed, event-driven graph queries run for each credit card transaction, providing comprehensive risk assessment in real-time. The system maintains sub-80-millisecond response times while processing the bank’s enormous daily transaction volume, proving that advanced graph analytics can operate at enterprise scale without sacrificing speed or accuracy.

Ready to Harness the Power of Connected Data?

Start your journey with TigerGraph today!