MDM Graph Database for Customer Journey Analytics

Build 360° Views of the Customer Journey With TigerGraph

Marketers Can Struggle to Fully Understand Customer Behaviors

Lengthy sales cycles, numerous touchpoints and too much data are among the biggest hurdles B2B marketers face when it comes to accurate attribution. In Chief Marketer’s 2019 B2B Marketing Outlook report, respondents lamented that the complexity of their sales cycle made it difficult to determine what was really having an impact.

Businesses are facing relentless increases in the volume, variety, and velocity of data coming at them from many different channels. Hidden within these data are insights that can aid them in accelerating growth by positively influencing the buying journey of customers.

A recent report from Nielsen found that only 25 percent of marketers have a high level of confidence in their ability to measure the ROI of their media spend.

Legacy Approaches Are an Obstacle to Fully Understanding Customer Behaviors

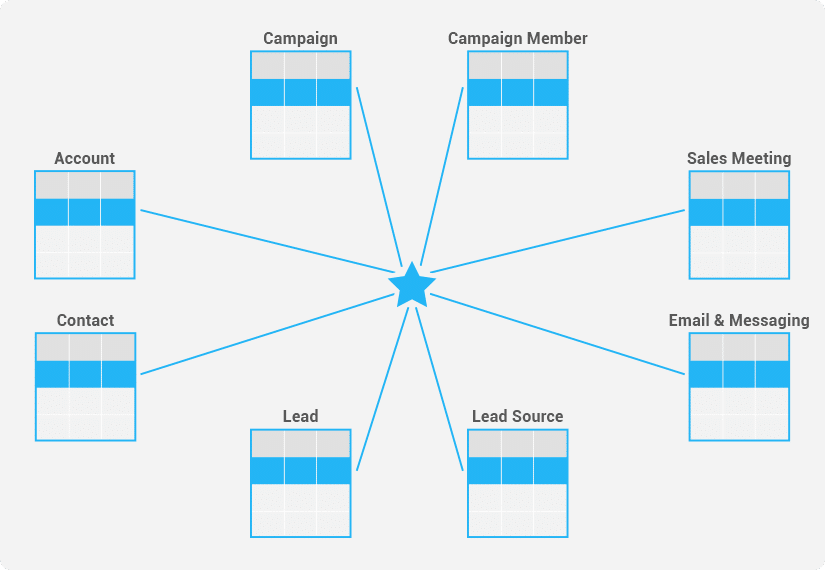

Traditional solutions are built upon relational databases, which store information such as account, contact, lead, campaign, and opportunity in separate tables, one for each type of business entity.

Relational databases are good tools for indexing and searching for data, as well as for supporting transactions and performing basic analysis. Relational databases are, however, poorly-equipped to connect across the tables or business entities and identify hidden relationships and patterns going across multiple leads, campaigns, and opportunities.

Why TigerGraph, a Native Parallel Graph Database for Real-time Customer 360/MDM?

Graph Analytics Can Provide a Seamless View of the Customer Journey

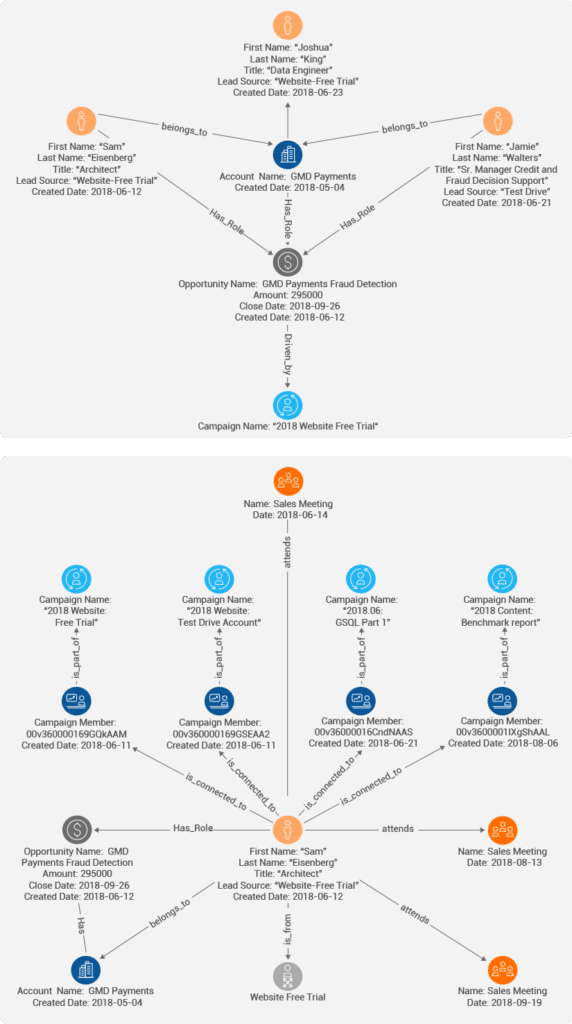

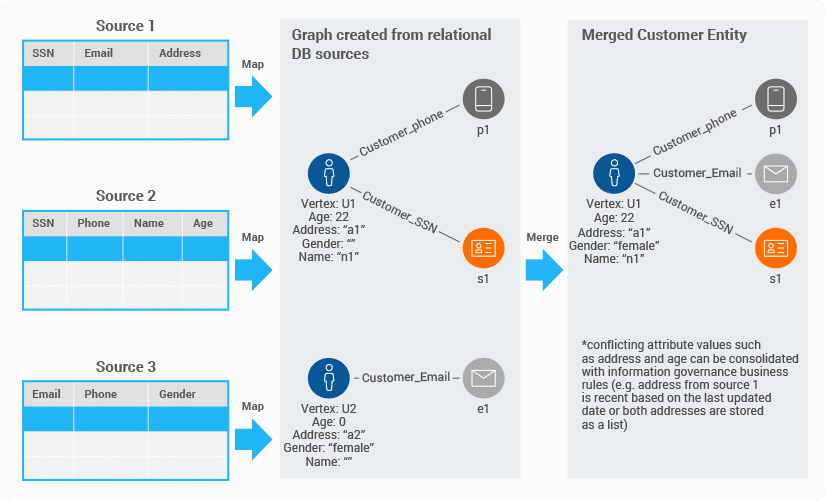

A graph database for MDM enables marketing teams to connect different types of information. A marketer can, for example, create a graph that identifies the names of the key people involved with an opportunity, along with their roles and the date of their involvement in the opportunity. A couple of clicks identifies specific actions of the individuals involved in the opportunity, such as downloading a white paper, watching a webinar, attending a meeting, downloading developer edition software, signing up for a cloud-based trial and more. The dates of each of these actions are displayed on the graph.

Consider the example of a TigerGraph sales opportunity with GMD Corporation, an internet, and eCommerce company. A marketer could, for example, use a graph for a “real-time fraud detection” opportunity for the company’s payment division, to determine that there were three stakeholders involved in this opportunity: Sam Eisenberg, Architect with GMD Payments Division, who came in via free trial on tigergraph.com website on June 11, 2018; followed by Jamie Walters, Senior Manager of Credit and Fraud Decision Support, who signed up for a test drive of the TigerGraph demonstration on June 21, 2018; and, finally, Joshua King, Data Engineer who signed up for a free trial of TigerGraph on June 23, 2018.

Finding the Customer Engagement and Attribution Patterns With a Graph Database for MDM

Consider the example of a TigerGraph opportunity with GMD Corporation, an internet, and eCommerce giant with diversified operations including the mobile wallet and payments. Digging deeper into the graph for a “real-time fraud detection” opportunity for their payment division, we can see that there were three stakeholders that were involved in this opportunity – Sam Eisenberg, an architect with GMD payments, who came in via free trial on tigergraph.com website on June 11, 2018, followed by Jamie Walters, Sr. manager of credit and fraud decision support who signed up for a test drive of the TigerGraph AntiFraud demonstration on June 21, 2018 and finally, Joshua King, Data Engineer who signed for the free trial of TigerGraph on June 23, 2018.

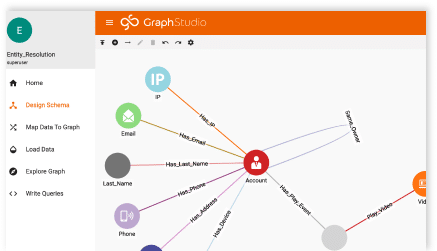

An opportunity was created on June 12 by the sales representative focused on GMD Payment account for the fraud detection. As we click on and drill down to look at the customer engagement for the architect, Sam Eisenberg in TigerGraph’s GraphStudio, we can see that Sam had a sales meeting with TigerGraph on June 14, 2018, following his request for TigerGraph free trial on June 11. He also signed up for the test drive on June 11 to watch the AntiFraud demonstration for TigerGraph. This was followed up with the webinar, GSQL part 1 on June 21, indicating increased interest from the prospect in TigerGraph’s portfolio. This was followed by the download of TigerGraph’s benchmark report on August 6, 2018, comparing the performance of TigerGraph with Amazon Neptune, Neo4j, ArangoDB, and JanusGraph. There were two more sales meetings with Sam and other GMD payments executives following the benchmark download. First sales meeting following the benchmark download was on August 13, a little more than a week after the download. This was followed by another sales meeting on September 19, 2018, which led to the final signed deal of 295,000 USD on September 26, 2018, for GMD payments fraud detection opportunity. TigerGraph analyzes the customer engagement data for all prospects, comparing them to the customer journey of Sam and other prospects that led to the signed deal. These insights allow marketers to design nurture streams and identify prospects that are prime for sales conversations around specific topics based on their journey maximizing probability of converting a lead into an opportunity and an opportunity into a signed deal.