NewDay Intercepts Fraudulent Credit Card Applications with TigerGraph Savanna

NewDay is a financial services company specializing in providing credit products to consumers in the United Kingdom. The company, whose revenues are approaching £1B, has eight million consumers across some of Britain’s largest online retailers and best-known credit cards.. NewDay’s innovative technology provides the ability to target the specific needs of customers with tailored products

The Challenge

NewDay’s strong footprint in the credit card market, including the subprime segment, comes with a high risk of fraud.

The Solution

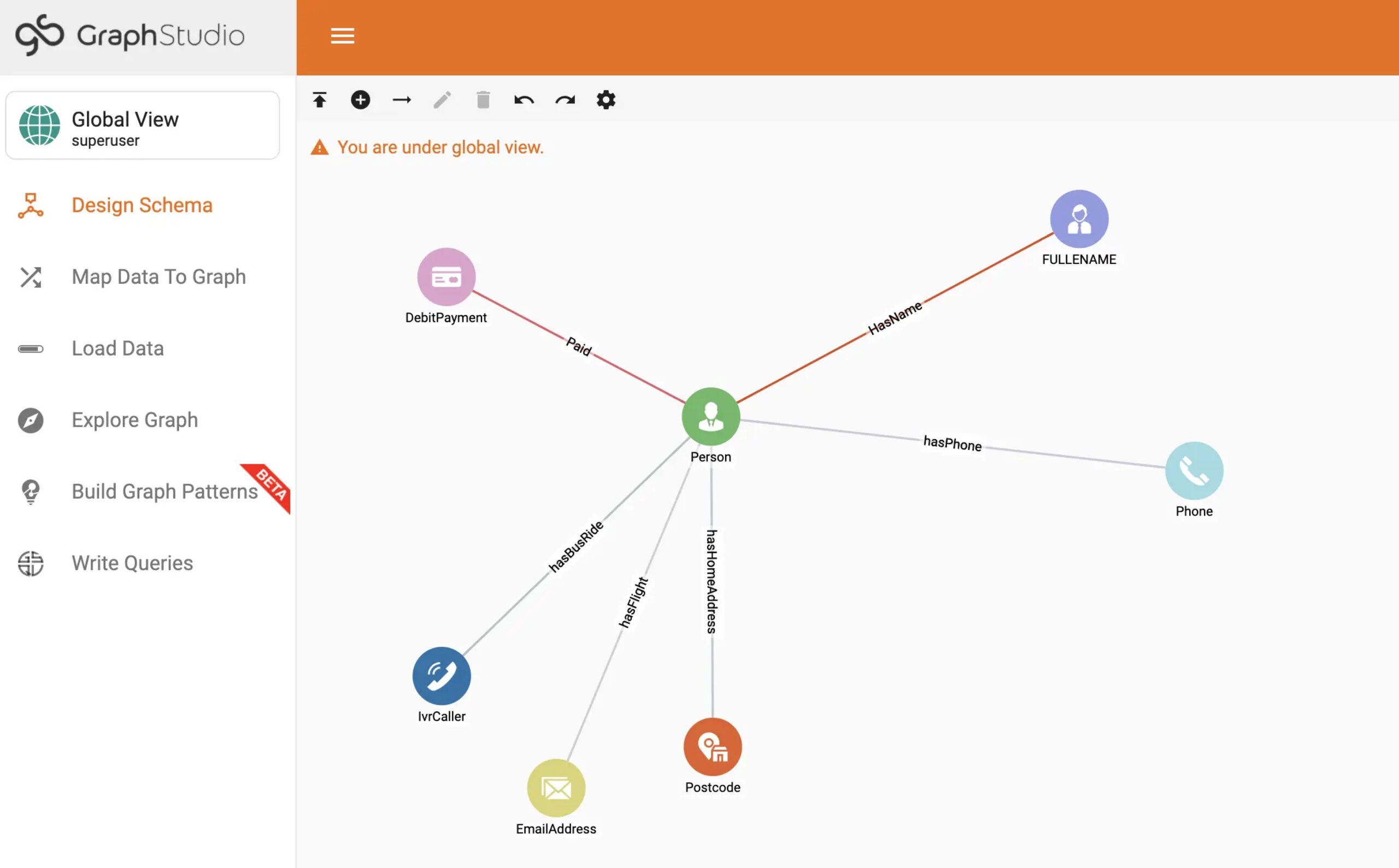

TigerGraph Savanna integrates data from multiple silos and utilizes advanced analytics and machine learning to find connections among NewDay accounts that are known to be fraudulent or suspected of being at risk.

The Results

NewDay is now able to identify and prevent fraudsters from joining their network by checking data against known and new fraud syndicates faster than ever before.

“We had looked into other graph analytics companies after we upgraded our data platforms, yet none provided the forward-looking technology, operational ease of use, training or support that TigerGraph did. In our ever-changing world with increasingly interconnected data, we needed to uplevel our technology offering. At the same time, we wanted to enable our fraud investigation team to act autonomously—without relying on developers—tuning queries in near real-time with ‘train-of-thought’ analysis and speed.”

The Challenge

NewDay’s strong footprint in the credit card market, including the subprime segment, comes with a high risk of fraud. Consequently, the company wanted to prevent fraudsters, especially those with connections to organized crime, joining one of their credit card networks. NewDay’s priority was to intercept these fraudsters as quickly as possible. Legacy databases could not analyze the necessary volumes of data at the required speeds so NewDay began searching for faster and more scalable solutions.

The Solution

TigerGraph Cloud integrates data from multiple silos and utilizes advanced analytics and machine learning to find connections among NewDay accounts that are known to be fraudulent or suspected of being at risk. NewDay’s fraud investigation teams autonomously tune queries in near real-time with ‘train-of-thought’ analysis and speed, without needing developer resources. NewDay is accomplishing this using TigerGraph Cloud, the first and the only scalable graph databaseas-a-service.

The Results

NewDay is now able to identify and prevent fraudsters from joining their network by checking data against known and new fraud syndicates faster than ever before. They use these insights to expose fraud rings and to shut down fraudulent accounts and detect those at risk. They anticipate that having this knowledge will allow them to detect fraud faster to reduce losses across all portfolios.

The data sciences team at Amgen is now able to support its colleagues in marketing and

The data sciences team at Amgen is now able to support its colleagues in marketing and

Ready to Harness the Power of Connected Data?

Start your journey with TigerGraph today!