Nubank Reduces Fraud Losses by Millions and Improves Detection Accuracy Using TigerGraph

The Challenge

Existing fraud detection methods missed complex patterns, costing hundreds of millions annually. Legacy systems struggled with accuracy and couldn’t scale to handle 50M+ daily transactions under 80ms response time requirements.

The Solution

Implemented TigerGraph’s high- speed graph database to analyze relationships and patterns in real- time. Integrated ML algorithms with graph features to detect synthetic fraud through complex queries and centrality clustering of suspicious accounts.

The Results

Achieved $50M in operational savings while protecting 60M households. Enhanced fraud detection accuracy with 30TB+ data processing capacity and sub- 80ms response times for real-time transaction analysis.

The Challenge

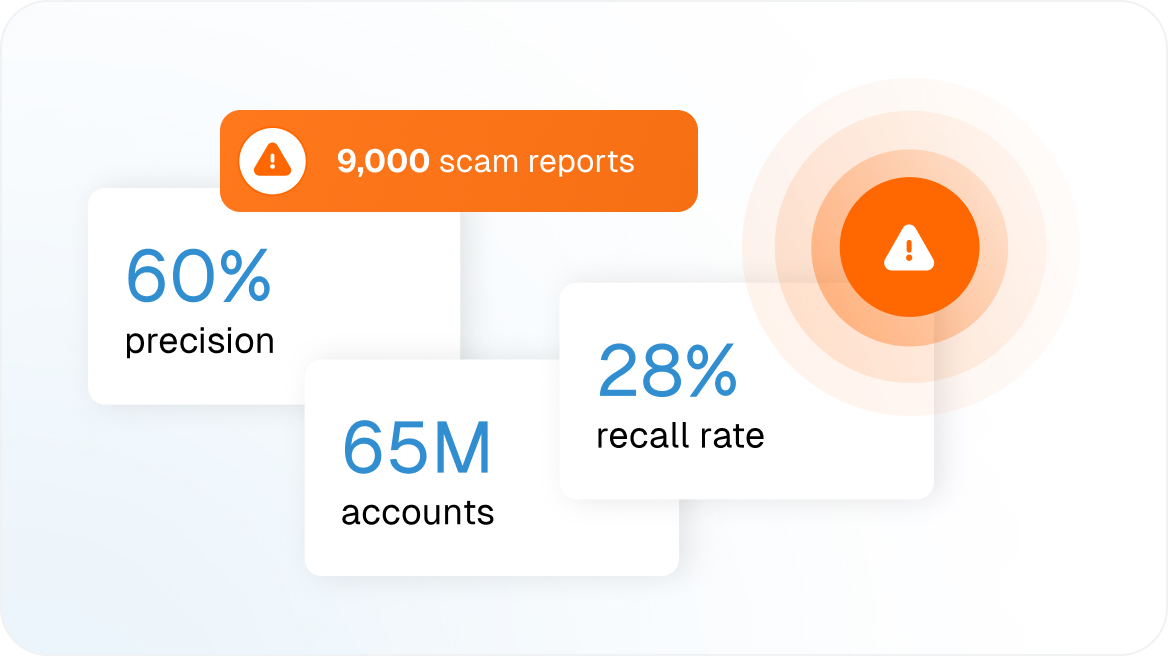

Nubank’s AML and fraud teams were drowning in an overwhelming surge of fraudulent activity that threatened both customer trust and financial stability. With over 9,000 scam reports flooding in monthly and approximately $1.8 million in associated losses, their legacy infrastructure built primarily on Google BigQuery was failing to meet critical operational demands. The system’s machine learning models achieved only 60% precision with a devastating 28% recall rate, meaning that not only were they generating excessive false positives that consumed valuable investigator time, but they were also missing the majority of actual fraud cases. This double failure created a perfect storm where legitimate customers faced unnecessary friction while criminals operated largely undetected across their 65 million account base, making scaling detection models increasingly impossible.

The Solution

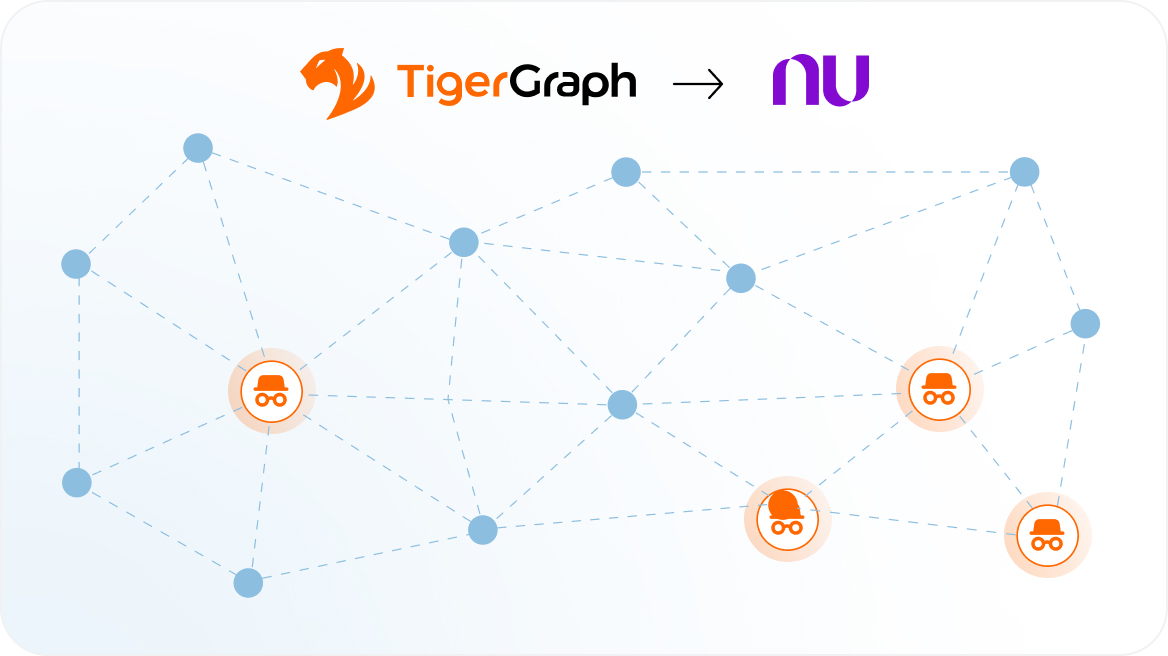

TigerGraph revolutionized Nubank’s fraud detection capabilities by injecting graph-native intelligence directly into their existing machine learning pipeline through a sophisticated, scalable approach. The implementation team, comprising AML leadership, fraud analysts, engineering, and analytics professionals, leveraged TigerGraph Cloud to calculate 30 powerful graph-based features that captured the complex relational patterns inherent in financial fraud networks. These features included critical proximity measurements and shortest path calculations to known mule accounts, enabling the system to identify suspicious relationships and money flow patterns that traditional tabular data analysis completely missed. The seamless integration into Nubank’s ML workflows meant they could

maintain their existing operational processes while dramatically enhancing detection accuracy through real-time relational insights that scaled effortlessly across their entire 65 million account ecosystem.

The Results

TigerGraph revolutionized Nubank’s fraud detection capabilities by injecting graph-native intelligence directly into their existing machine learning pipeline through a sophisticated, scalable approach. The implementation team, comprising AML leadership, fraud analysts, engineering, and analytics professionals, leveraged TigerGraph Cloud to calculate 30 powerful graph-based features that captured the complex relational patterns inherent in financial fraud networks. These features included critical proximity measurements and shortest path calculations to known mule accounts, enabling the system to identify suspicious relationships and money flow patterns that traditional tabular data analysis completely missed. The seamless integration into Nubank’s ML workflows meant they could maintain their existing operational processes while dramatically enhancing detection accuracy through real-time relational insights that scaled effortlessly across their entire 65 million account ecosystem.

Ready to Harness the Power of Connected Data?

Start your journey with TigerGraph today!