Detect Money Laundering (AML) With TigerGraph

Minimum estimated size of the money laundering globally per year

Cost of AML compliance across the US fin. services sector

AML fine levied against Commonwealth Bank of Australia

Money Laundering Is Costing the Economy Billions

Money laundering and financial fraud is a problem that has become even harder to track with the proliferation of real-time digital transfers and payments, complex international laws and the rise of cryptocurrencies. The United Nations Office of Drug and Crime estimates that money laundering is 2-5% of global GDP (or $800 billion-$2 trillion). Governments across the world have increased regulatory oversight to stop money laundering, driving unprecedented demand for sophisticated AML software and anti money laundering solutions that can keep pace with evolving criminal tactics.

Traditional financial institutions are struggling to combat these threats with outdated systems, creating an urgent need for next-generation anti money laundering software for banks that can analyze complex transaction patterns in real-time. The regulatory landscape continues to tighten, with penalties for non-compliance reaching into the billions of dollars, making robust AML solutions not just a regulatory necessity but a business imperative.

Read More

Legacy Approaches to Solving Money Laundering Are Insufficient

Virtually all existing anti-money laundering compliance systems are built upon relational databases, which store information (customer, account, transaction, etc.) in rows and columns. Relational databases are great tools for indexing and searching for data, as well as for supporting transactions and performing basic statistical analysis. They are poorly suited to connecting dots and identifying hidden relationships, which is essential for analyzing money trails and assessing their money laundering risk. Such queries could take hours or even days to run, rendering any meaningful analysis of linkages among parties and transactions practically impossible.

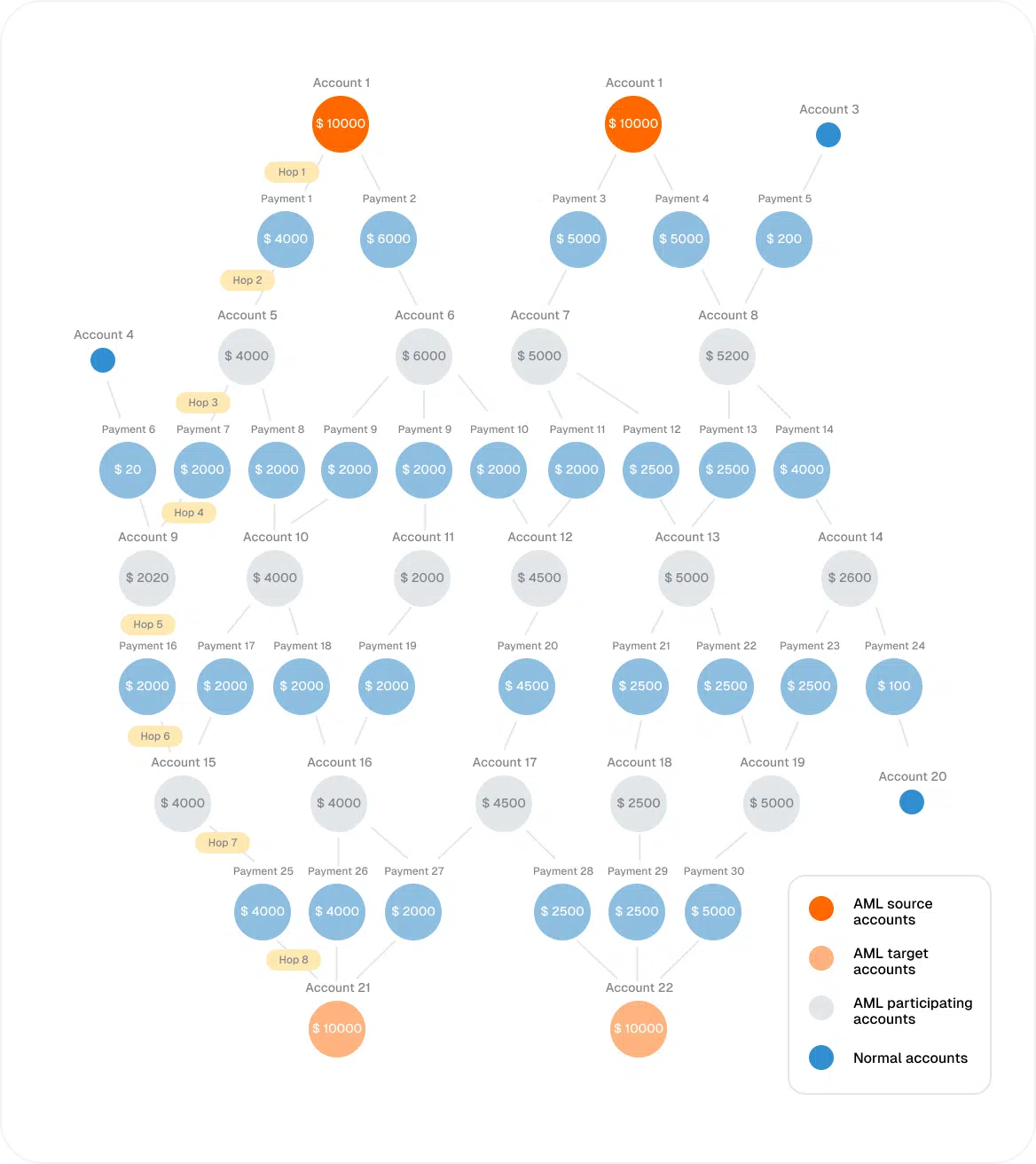

Detecting money laundering and financial fraud requires going beyond individual account behavior, analyzing relationships among groups of accounts or entities over time often combining information from third party sources. Traditional money laundering solutions built on relational databases were not designed to address this challenge.

Most legacy AML transaction monitoring software relies on rule-based systems that generate alerts based on predetermined thresholds and patterns. While these systems can catch some obvious suspicious activities, they fail to detect sophisticated laundering schemes that involve multiple entities, jurisdictions, and transaction types. The complexity of modern financial networks requires anti-money laundering software that can process vast amounts of interconnected data and identify subtle patterns that indicate potential money laundering activities.

Furthermore, traditional banking AML software often operates in silos, analyzing individual transactions or accounts without considering the broader network of relationships. This fragmented approach leaves significant blind spots that sophisticated criminals exploit to move illicit funds through the financial system undetected.

Read More

Database for AML?

Reduce False Positives With Deep Link Analytics

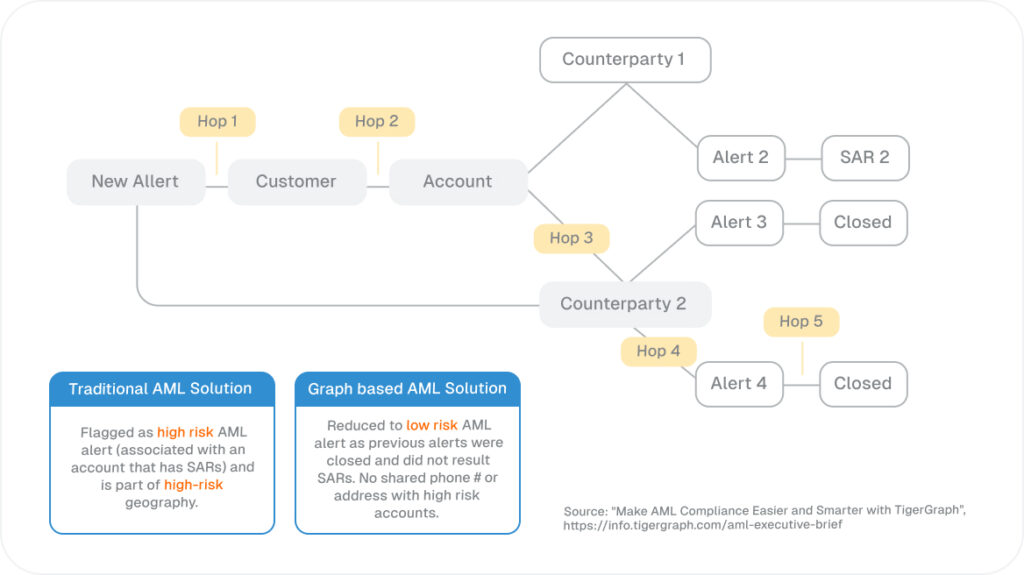

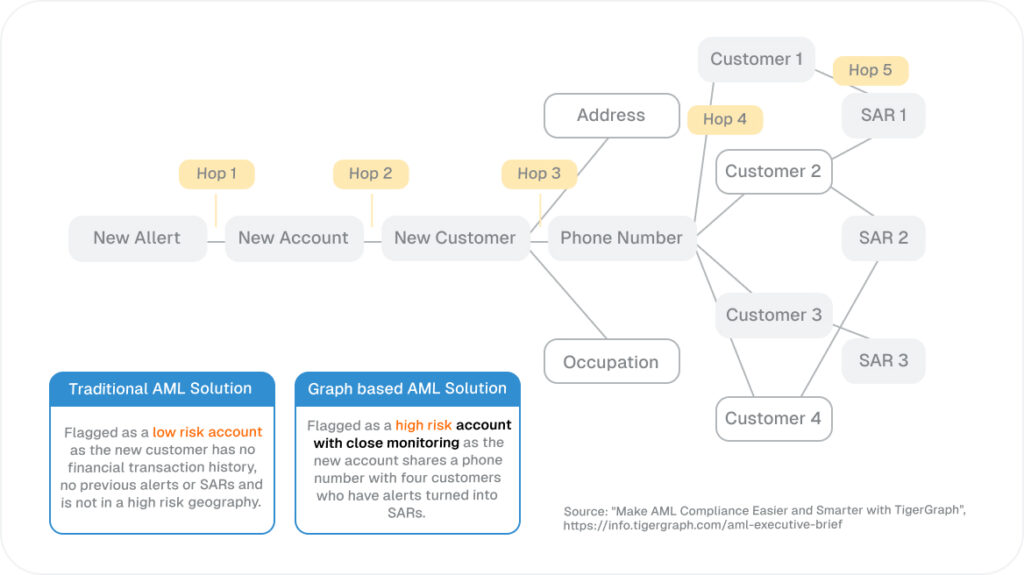

Approximately 95% of the money laundering alerts raised with legacy systems are unrelated to money laundering. This staggering false positive rate creates enormous operational overhead for financial institutions, requiring thousands of compliance officers to manually review alerts that ultimately prove to be legitimate transactions.

Advanced anti-money laundering analytics powered by graph technology can dramatically reduce these false positives by providing context that traditional systems lack. Instead of evaluating transactions in isolation, graph-based AML anti money laundering software analyzes the entire network of relationships surrounding each transaction, including:

- Historical transaction patterns between entities

- Shared identifiers and contact information

- Geographic and temporal clustering of activities

- Cross-institutional relationships and dependencies

- Third-party data enrichment from external sources

This comprehensive view enables anti money laundering solutions tools to distinguish between legitimate business relationships and suspicious patterns with much greater accuracy. Financial institutions implementing graph-based AML solutions typically see false positive rates drop from 95% to as low as 10-20%, representing massive cost savings and improved operational efficiency.

The deep link analytics capabilities also enable compliance teams to prioritize their investigations more effectively, focusing their limited resources on the alerts most likely to represent genuine money laundering activities. This targeted approach not only improves detection rates but also accelerates case resolution times.

Read More

Graph Analytics Can Reduce False Negatives in Money Laundering Detection

Machine Learning Improves the Accuracy of Money Laundering Detection

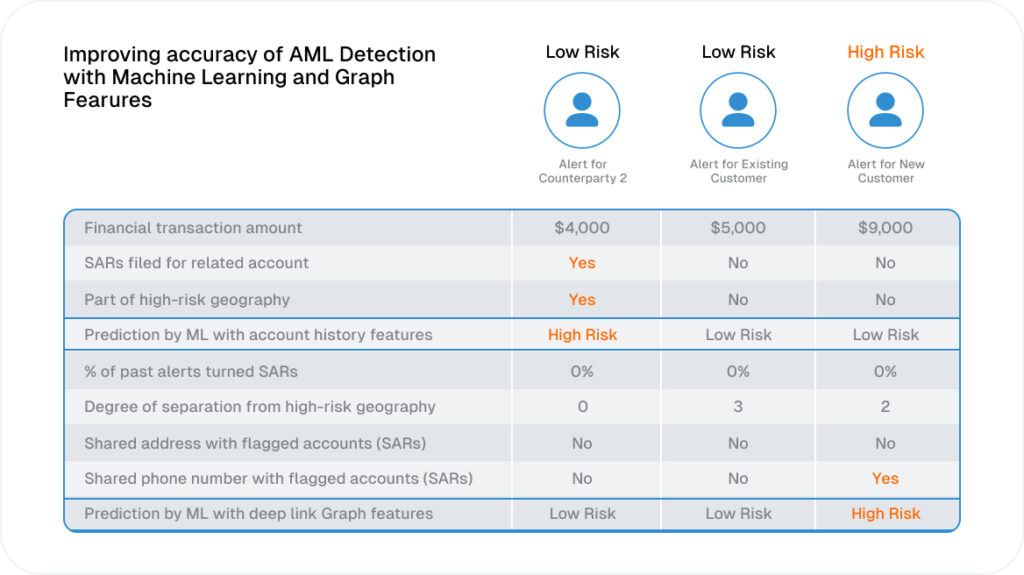

Machine learning has been integrated by multiple financial service providers with their existing anti-money laundering solutions. However, the accuracy for AML detection is quite poor, as the traditional solutions generate a lot of false positive alerts, feeding those as training data into artificial intelligence. This, in turn, affects the accuracy for predicting AML activity.

When machine learning algorithms are trained on data from legacy systems with 95% false positive rates, they learn to perpetuate these same biases and inefficiencies. Graph-based anti money laundering (AML) software solves this problem by providing cleaner, more contextual training data that enables machine learning models to achieve much higher accuracy rates.

The combination of graph analytics and machine learning creates a powerful synergy in modern anti money laundering solutions. Graph algorithms can identify complex network patterns and anomalies, while machine learning models can learn from these patterns to predict future money laundering activities with greater precision. This hybrid approach enables:

- Adaptive detection models that evolve with changing criminal tactics

- Automated feature engineering from graph topology and dynamics

- Real-time risk scoring based on network context

- Continuous learning from investigator feedback and case outcomes

- Personalized risk profiles that account for individual customer behavior patterns

Financial institutions using this advanced approach report detection accuracy improvements of 300-500% compared to traditional rule-based systems, while simultaneously reducing false positive rates and operational costs.

Read More

FAQ

Traditional anti money laundering software built on relational databases struggles with the complexity of modern money laundering schemes. Money launderers create intricate networks involving multiple entities, shell companies, and jurisdictions to obscure the trail of illicit funds. Relational databases store data in isolated tables and cannot efficiently analyze the multi-hop relationships and complex patterns that characterize sophisticated laundering operations. Queries that trace connections across multiple degrees of separation can take hours or days to execute, making real-time detection impossible and leaving institutions vulnerable to regulatory penalties.

Graph databases are fundamentally designed to model and analyze relationships, making them ideal for anti money laundering analytics. Unlike relational systems that struggle with complex joins across multiple tables, graph databases store relationships as first-class entities, enabling instantaneous traversal of complex networks. This allows AML software to identify suspicious patterns such as circular flows, layered transactions, and shell company networks in real-time. Graph algorithms can detect money laundering schemes that span dozens of intermediary accounts across multiple institutions—patterns that would be impossible to identify with traditional SQL-based approaches.

Graph-based anti money laundering software excels at identifying sophisticated laundering schemes including: smurfing operations where large amounts are broken into smaller transactions across multiple accounts, trade-based money laundering involving over/under-invoicing between related entities, layering schemes that move funds through complex webs of shell companies, integration patterns where laundered funds are mixed with legitimate business transactions, and coordinated mule account networks that distribute illegal proceeds. These patterns involve complex relationship analysis that traditional rule-based systems cannot effectively detect.

Traditional AML transaction monitoring software generates approximately 95% false positives because it evaluates transactions in isolation without considering relationship context. Graph-based banking AML software dramatically reduces false positives by analyzing the full network context surrounding each transaction. Instead of flagging every large cash deposit, graph analytics can determine if the deposit fits within established business relationships, historical patterns, and legitimate transaction flows. This contextual understanding enables compliance teams to focus on genuine suspicious activities rather than wasting resources investigating legitimate business transactions.

Yes, graph databases excel at unsupervised anomaly detection in financial networks. While traditional anti money laundering solutions rely on predefined rules and known patterns, graph analytics can identify unusual network structures and transaction flows that may indicate new laundering techniques. By analyzing network topology, centrality measures, and flow patterns, graph-based AML anti money laundering software can flag anomalous behaviors even when they don’t match existing rule sets. This capability is crucial as money launderers continuously evolve their methods to evade detection.

Graph databases are specifically engineered for enterprise-scale anti money laundering software for banks. They can analyze networks containing billions of entities and relationships while maintaining sub-second query response times. Graph databases use specialized storage and indexing optimized for relationship traversal, enabling real-time analysis of complex money laundering networks that would overwhelm traditional systems. This scalability is essential for large financial institutions processing millions of transactions daily while maintaining comprehensive AML surveillance.

Cross-border money laundering involves complex networks spanning multiple jurisdictions, currencies, and financial institutions. Graph-based anti-money laundering software can integrate data from various sources and analyze the global network of relationships that money launderers exploit. Traditional systems typically operate in silos and cannot effectively connect activities across different institutions or countries. Graph databases enable comprehensive network analysis that reveals how funds flow through multiple jurisdictions, identifying suspicious patterns that span international boundaries.

Graph visualization and analytics dramatically improve AML investigation efficiency by providing investigators with intuitive network views of suspicious activities. Instead of manually piecing together information from multiple database queries and reports, investigators can visualize the entire network surrounding a suspicious transaction in seconds. Graph-based anti money laundering solutions tools enable investigators to quickly identify all related entities, trace fund flows, and understand the complete scope of potential money laundering schemes. This comprehensive view accelerates case resolution and improves the quality of Suspicious Activity Reports (SARs).

Graph-based AML solutions provide significant regulatory advantages by enabling more comprehensive and accurate reporting to authorities. The detailed relationship analysis and network visualization capabilities help institutions provide regulators with complete pictures of suspicious activities rather than fragmented transaction reports. Graph databases also maintain comprehensive audit trails and data lineage, supporting regulatory examinations and demonstrating due diligence in AML compliance efforts. The improved detection accuracy and reduced false positives help institutions avoid regulatory penalties while better fulfilling their obligations to combat financial crime.

Graph databases generate rich feature sets that dramatically improve machine learning accuracy for anti money laundering (AML)l software. Network-based features such as centrality measures, clustering coefficients, and path analysis provide machine learning models with meaningful inputs that traditional transaction data cannot offer. These graph-derived features are more stable and interpretable than raw transaction attributes, leading to more robust and explainable AI models. Additionally, graph neural networks can learn directly from network structure, enabling the detection of complex money laundering patterns that traditional machine learning approaches would miss.