Fight Fraud with TigerGraph

The Best Fraud Detection Graph Database – Powerful fraud detection software that catches fraud in real-time with advanced machine learning and deep link analytics

Mobile eCommerce fraud costs rose from 5% in 2020 to 39% in 2021

The cost of fraud for U.S. banks is 13% higher in 2021 than before the pandemic

Every $1 of fraud now costs U.S. retail and eCommerce merchants $3.60 in 2021

Fraud is Expensive and Becoming More Prevalent

Fraud is a growing problem in all industries, with eCommerce losses alone exceeding $57.8 billion in 2017. For every dollar involved in fraudulent transactions, the financial services industry spends $2.67 dealing with chargebacks, fees, interest, and labor.

Read More

Fraudsters Are Becoming Increasingly Sophisticated

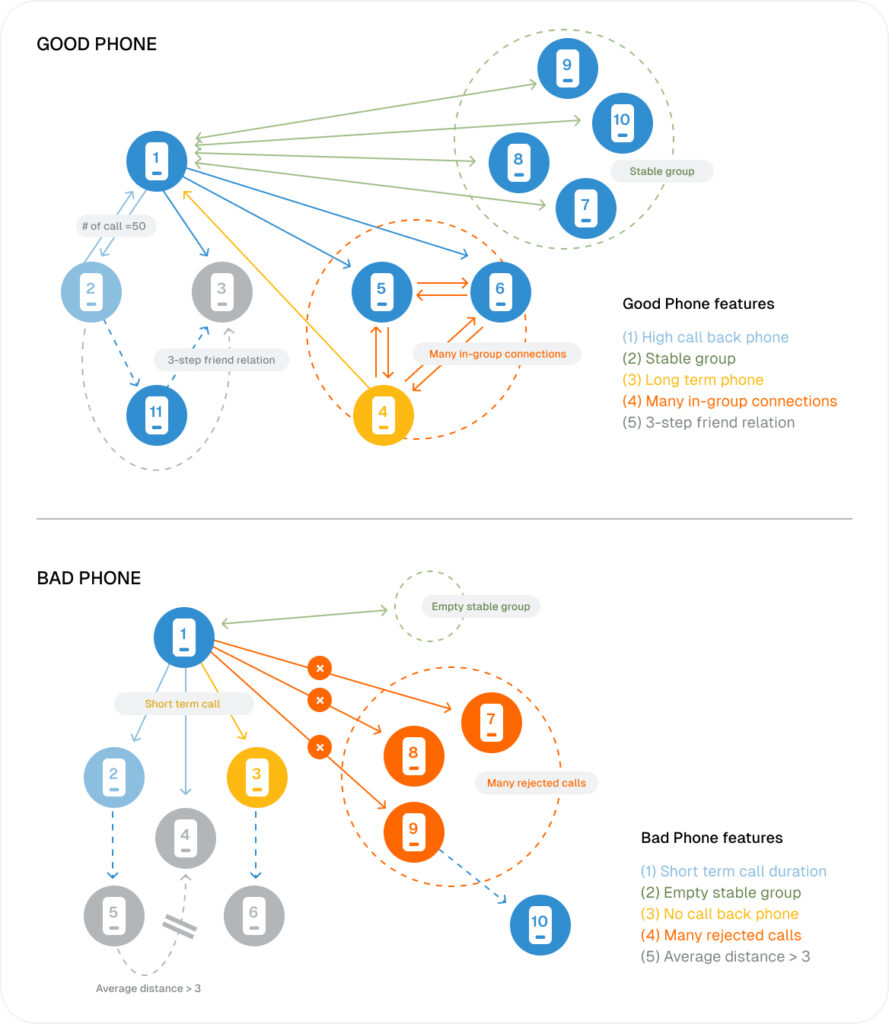

Fraudsters are getting more sophisticated over time, creating a network of synthetic identities combining legitimate information like social security or national identification number, name, phone number, and physical address. Legacy fraud detection systems are largely based on the analysis of the behavior of an individual business entity, such as a customer, citizen, device, doctor, or healthcare provider, and find unusual patterns in that behavior.

Fraud is perpetrated using fake accounts created with synthetic identities. Each individual fraud account looks and behaves much like a legitimate account, making detection much harder with traditional solutions. Fraud detection using graph database technology requires going beyond individual account behavior, analyzing relationships among groups of accounts or entities over time, while often combining information from third party sources. Traditional fraud solutions built on relational databases were not designed to address this challenge, which is why organizations are turning to graph database for fraud detection capabilities.

Read More

Graph Database, Help Find Fraud?

Graph Database Fraud Detection with Deep Link Analytics

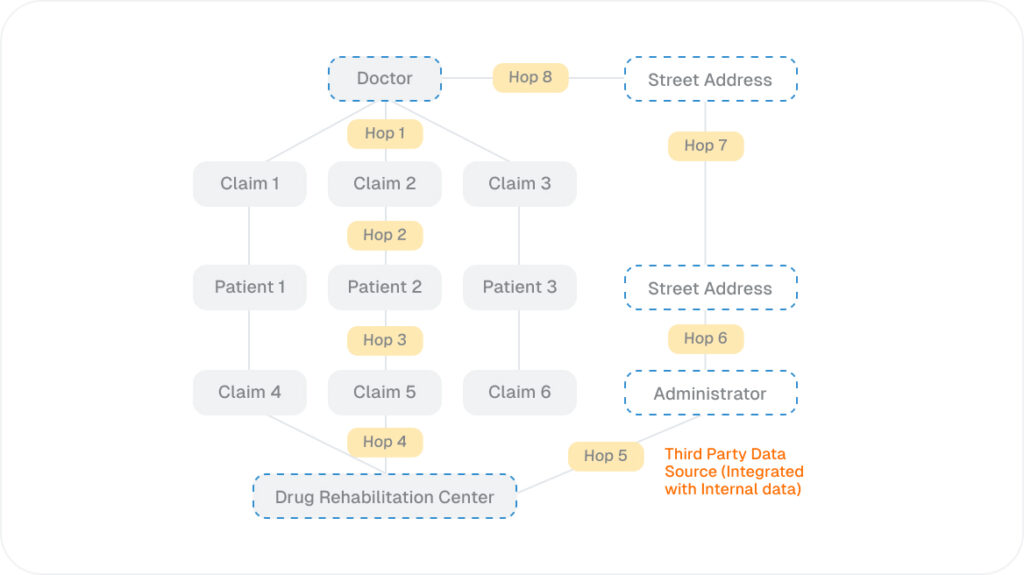

Graph fraud detection excels in scenarios like healthcare fraud related to opioid addiction treatment centers. Take this graph database fraud detection example: A provider is prescribing a large number of patients to one specific opioid or drug addiction treatment center. Traditional fraud solutions can’t find anything unusual based on the information available for the doctor as well as the treatment center.

TigerGraph’s graph analytics fraud detection capabilities tap into the enterprise knowledge graph from a third-party source — such as Thomson Reuters or Dunn & Bradstreet — to find all known administrators for the drug treatment center and their current and previous addresses listed in the public domain. One of the previous addresses for the administrator is very close to the address for the physician prescribing patients to the drug treatment center.

In order to detect this hidden relationship between the doctor and the administrator, TigerGraph executes a query that goes eight hops across claims for patient visits and opioid treatment center claims by the same patients. Combining that with the third-party knowledge repository data such as addresses and phone numbers reveals the collusion. Traditional fraud solutions built on relational databases struggle to incorporate new data sources from third parties due to rigid schema and require computationally intensive database joins, rendering deep link analysis infeasible. This is where a fraud detection graph database provides clear advantages.

Read More

Accelerate Detection with Real-Time Analytics

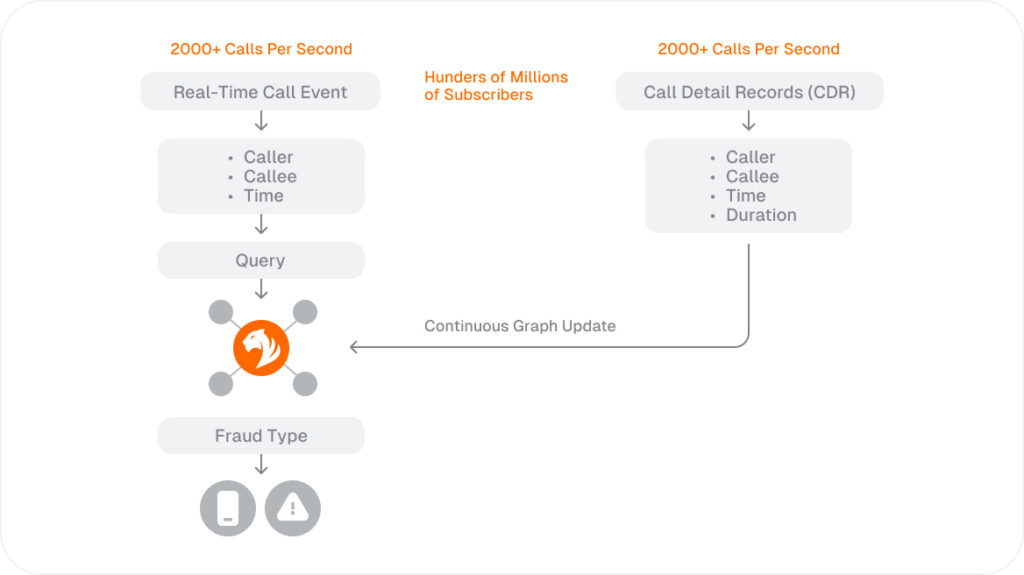

Fraud detection graph technology is time-sensitive: every passing minute, hour, and day that fraud goes undetected results in increasing losses for your organization as well as for your customers or citizens. TigerGraph stands as the top fraud detection graph database, purpose-built for real-time fraud detection to address this challenge. Our fraud prevention database capabilities ensure rapid response to emerging threats.

Read More

Improve Fraud Detection with Machine Learning

Less than 1% of the total call volume for telecom or claims data for healthcare and government benefits or payment transactions for financial services are fraudulent. This means that the machine learning models do not have sufficient training data with confirmed fraud activity to learn and improve their accuracy.

TigerGraph’s native parallel graph database is purpose-built to address this challenge, establishing itself as the top graph database for fraud detection. Our platform combines the power of fraud detection graph database technology with advanced machine learning algorithms to deliver superior accuracy and performance in identifying fraudulent activities across complex relationship networks.

Read More

Ready to Harness the Power of Connected Data?

FAQ

A fraud detection graph database is a specialized database designed to store and analyze interconnected data as nodes and relationships. Unlike traditional relational databases, graph databases excel at detecting complex fraud patterns by analyzing connections between entities like accounts, transactions, devices, and users in real-time.

Graph database fraud detection works by mapping relationships between different entities and analyzing patterns across these connections. It can identify suspicious clusters, detect synthetic identity rings, find hidden relationships between fraudsters, and spot anomalous behavior patterns that would be impossible to detect using traditional row-and-column database approaches.

Graph databases for fraud detection offer several key advantages:

- Real-time analysis of complex relationship networks

- Deep link analytics that can traverse multiple hops to uncover hidden connections

- Scalability to handle billions of transactions and relationships

- Flexibility to incorporate new data sources without schema changes

- Speed in executing complex queries across vast networks

- Accuracy in identifying sophisticated fraud schemes like synthetic identity theft

A common graph database fraud detection example involves credit card fraud rings. Traditional systems might miss individual fraudulent transactions that appear normal in isolation. However, a graph database can identify that multiple “different” accounts share the same device fingerprint, IP address, or phone number, revealing a coordinated fraud ring. The system can then flag all related accounts and transactions in real-time.

Traditional relational databases struggle with fraud detection graph scenarios because they require complex joins to analyze relationships, which become computationally expensive at scale. Graph analytics fraud detection is purpose-built for relationship analysis, making multi-hop queries and pattern detection significantly faster and more efficient.

Fraud detection using graph database technology can identify various fraud types including:

- Identity theft and synthetic identity fraud

- Account takeover schemes

- Payment fraud and money laundering

- Insurance fraud networks

- Healthcare fraud conspiracies

- First-party fraud and bust-out schemes

- Ecommerce and marketplace fraud

The best fraud detection graph database solutions can analyze relationships and detect fraud patterns in milliseconds to seconds, enabling real-time fraud prevention. This speed is crucial since every minute fraud goes undetected results in increased losses.

TigerGraph stands as the top fraud detection graph database because it offers:

- Native parallel processing for faster query execution

- Real-time analytics capabilities

- Scalability to handle enterprise-level data volumes

- Machine learning integration for improved accuracy

- Deep link analytics that can traverse 10+ hops efficiently

- Proven track record with major financial institutions and government agencies