Graph Analytics for FinTech: Solving What Traditional Databases Can’t

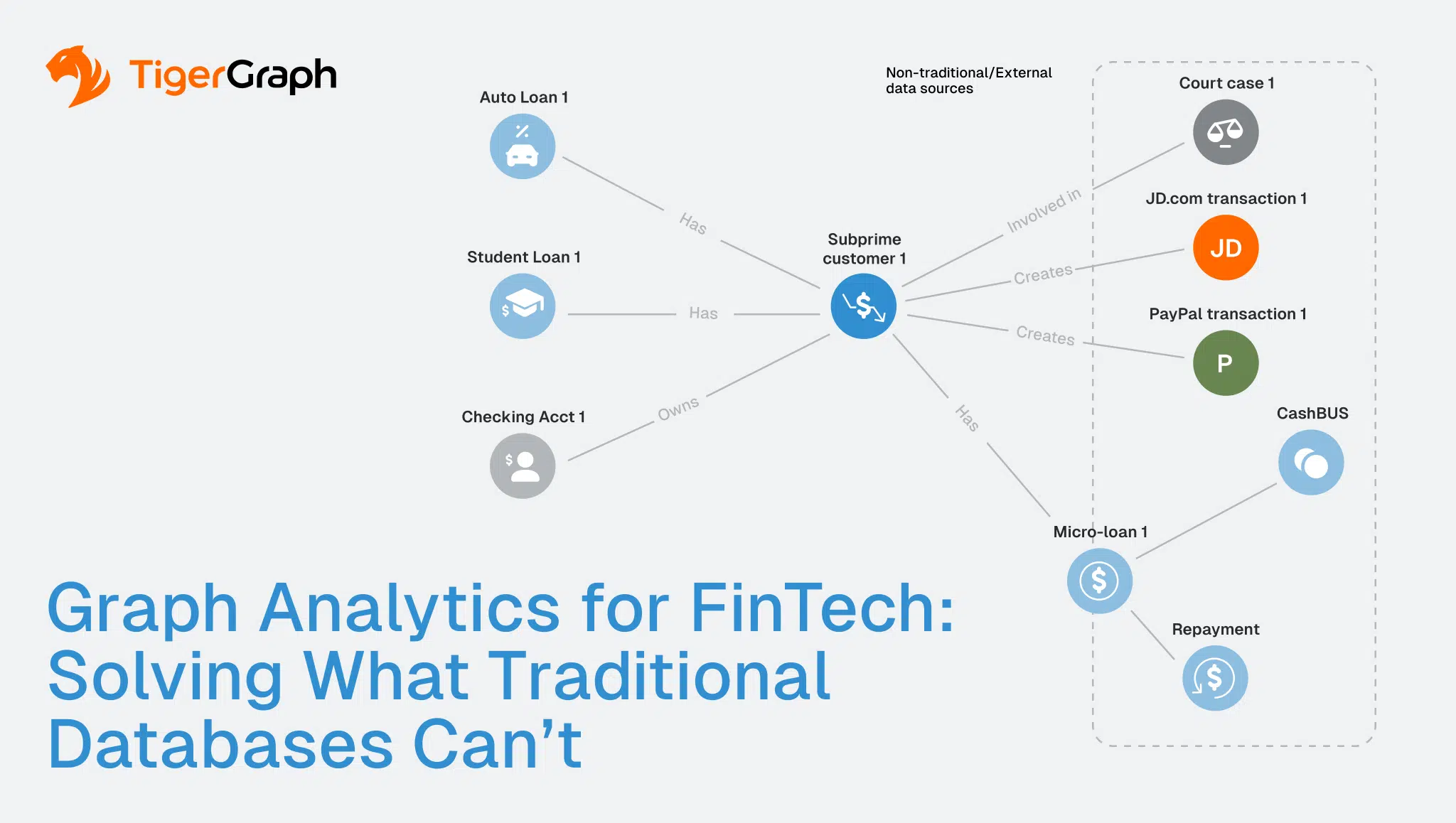

Financial services today operate in a world defined by complexity—of products, of regulations, and most importantly, of relationships. From fraud detection to risk management and portfolio modeling, financial institutions are not struggling with a lack of data; they’re struggling with context. Traditional relational databases flatten this context, reducing connected events to isolated rows and forcing teams to guess at what the data actually means.

That’s a costly limitation.

Graph analytics changes this dynamic by treating relationships as first-class data. It enables financial systems to reason through connections—between the many people, accounts, devices, transactions, and events—and all in real time. For FinTech organizations that need speed, scale, and trust in what their systems detect, recommend, or approve, graph-native infrastructure has become foundational.

The Core Challenges FinTech Can’t Solve in Rows

FinTech companies are constantly under pressure to deliver smarter, faster decisions—but the problems they face aren’t flat. From fraud detection to long-tail portfolio optimization, these challenges are inherently connectional. Traditional relational databases treat data as isolated rows, but financial interactions rarely exist in isolation.

Take fraud and anti-money laundering (AML), for instance. While different operational mandates govern them—fraud being an economic risk, AML a regulatory one—both are deeply connectional problems that graph analytics is uniquely equipped to address. Money doesn’t move in straight lines—it moves through intermediary accounts, shared devices, synthetic identities, and often in circular or layered transaction paths. By the time a traditional system flags an anomaly, the damage has already been done. Graph analytics, on the other hand, sees the pattern while it’s still unfolding.

Know Your Customer poses another major challenge. Customers often have multiple accounts, reuse devices, or share credentials across platforms. Without dynamically modeling these relationships, financial institutions risk either missing high-risk connections or mistaking legitimate activity for fraud. The same is true in portfolio risk management, where evaluating counterparty risk or asset exposure means understanding how holdings and investments connect—not just what they contain.

Even when FinTechs focus on growth and personalization, they face the same limitations. Building a true Customer 360 view or modeling a user journey requires linking signals, transactions, and behaviors across time and channels. When those connections are stored in flat rows and disjointed systems, key insights are lost or delayed.

These are not merely technical headaches. They are business-critical blind spots that aren’t rooted in a lack of data but in using the wrong structure to understand it.

How Graph Analytics Solves FinTech Problems

Graph analytics makes existing FinTech processes faster, and it unlocks entirely new ways to reason about data. It allows institutions to model risk, behavior, and opportunity as they actually exist—in complex, evolving networks.

TigerGraph’s Anti-Fraud Demo illustrates this. Instead of relying on isolated thresholds or static rules, it models suspicious activity as a dynamic network of transactions, accounts, devices, and behaviors. It reveals money-laundering patterns in real-time—such as circular flows and layering tactics like smurfing, where large sums are broken into smaller transactions and routed through multiple intermediaries to evade detection. This allows investigators to act before funds vanish, not after they’re gone.

In portfolio management, graph analytics helps firms run advanced simulations of how market events might cascade through investment networks. With probabilistic models and causal reasoning layered into the graph, TigerGraph supports what-if analysis that accounts for relationship strength, exposure chains, and multi-market interdependencies—something traditional models can’t do without heavy pre-processing and approximation.

Graph-based identity resolution links user records using behavioral signals, shared attributes, and transaction paths. This makes it easier to flag synthetic identities, catch coordinated behavior, or reconcile disparate records across systems—all in real time. Similarly, graph-powered customer journey modeling helps FinTechs surface the next-best action, cross-sell opportunity, or risk signal—based on where a customer is in their lifecycle and how similar users have behaved.

Unlike batch-based systems that depend on rigid joins and precomputed relationships, TigerGraph enables these insights to emerge dynamically from the data’s inherent structure. Relationships aren’t stitched together—they’re already there, ready to be explored.

Why TigerGraph Is Built for FinTech’s Realities

TigerGraph isn’t just another graph database. It’s a purpose-built graph analytics platform designed to handle real-time, enterprise-scale workloads—exactly the kind of workloads FinTech demands. In a space where speed, explainability, and regulatory readiness aren’t optional, TigerGraph delivers where others fall short.

Performance is foundational. TigerGraph supports sub-second queries even when analyzing billions of relationships. This means fraud detection, identity matching, and risk evaluation can happen as events unfold—not after the fact. The architecture is built for massively parallel processing, and the GSQL language empowers teams to write deep, multi-hop analytics queries without sacrificing speed or readability. It’s optimized for analytics, not just pattern matching.

Just as important is explainability. Whether for compliance, internal auditing, or customer transparency, every outcome generated within TigerGraph can be traced—down to the entities, relationships, and logic that informed it. When regulators or executives ask “why,” TigerGraph provides the answer in clear, auditable form.

Another core strength is real-time ingestion. Financial environments don’t wait for batch cycles. TigerGraph continuously integrates streaming data from APIs, logs, payment platforms, and transaction systems, keeping the graph model live, accurate, and contextually aware at all times.

And because FinTech infrastructures vary, TigerGraph is flexible in how it’s deployed. Whether on-prem, cloud-native, or hybrid, its distributed architecture scales horizontally without requiring costly reengineering.

For FinTech teams, this isn’t just about adopting a better database—it’s about unlocking a smarter, more agile way to reason through data at scale, in context, and in real time.

FinTech Is a Graph Problem—TigerGraph Makes It Solvable

The most valuable insights in FinTech live in the connections between accounts, transactions, entities, and behaviors. Traditional databases weren’t built for those connections, but graph analytics are.

TigerGraph delivers the speed, reasoning, and scalability FinTech demands. It empowers financial institutions to move from after-the-fact alerting to real-time reasoning, from reactive flagging to explainable intelligence, and from row-based limits to relationship-powered decisions.

FinTech is fundamentally a graph problem. TigerGraph makes it solvable, scalable, and explainable. Reach out to learn more today!