How Graph Databases Power AML/KYC in Banking

Compliance is at a breaking point. Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements have never been more demanding. Banks are expected to stop financial crime while maintaining seamless customer experiences, and all under the scrutiny of regulators who demand accuracy, auditability, and explainability.

The challenge isn’t just volume. It’s complexity. Customers span multiple products, jurisdictions, and digital channels. Criminals exploit these layers with synthetic identities, nested ownership structures, and cross-border transactions that look ordinary on their own but form high-risk patterns in combination.

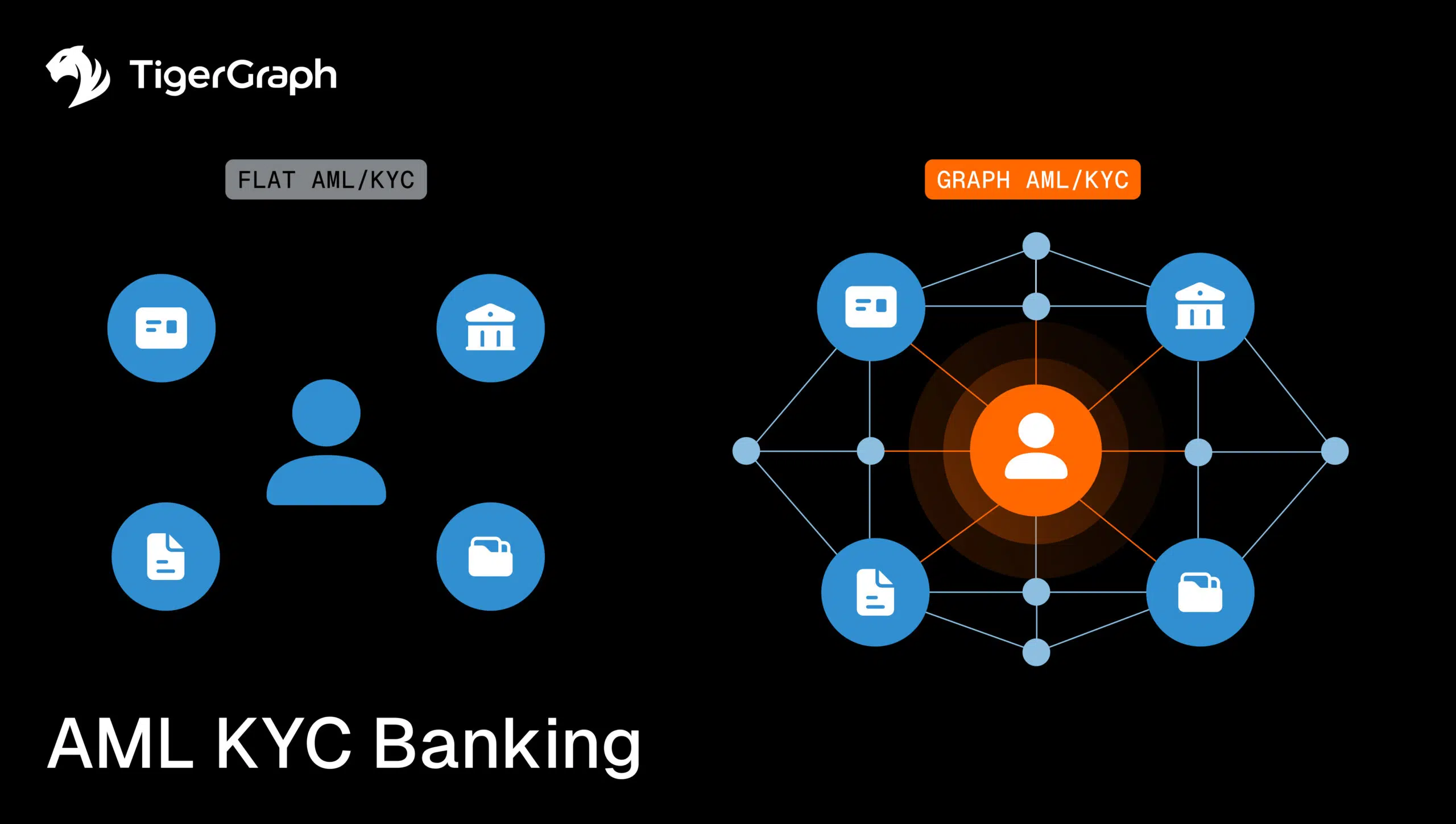

Traditional compliance systems weren’t built for this. Flat models and siloed databases can confirm a customer’s identity at onboarding or flag a large transaction after the fact, but they struggle to capture the relationships that define whether a client or transaction is truly high risk.

Why Flat Models Fall Short in AML/KYC

Traditional AML and KYC systems were designed for a simpler era of banking. Today, their limitations are showing.

Customer data is often siloed across business lines and geographies. A retail banking profile may live in one system, a commercial loan record in another, and wealth management details in a third. These systems rarely align, creating duplicates and blind spots that make it nearly impossible to maintain a true single view of the customer. Criminals exploit these cracks, spreading activity across silos to avoid detection.

Even when data is available, most compliance programs rely heavily on static rules and thresholds. Transfers over $10,000 get flagged, certain countries or industries trigger enhanced due diligence, and so on.

While these rules are necessary, they generate an overwhelming number of false positives that bury compliance teams in alerts. Analysts spend valuable time chasing anomalies that look suspicious in isolation but have no real risk when viewed in context, while more sophisticated, coordinated laundering activity slips under the radar.

Finally, many banks treat KYC as a snapshot exercise: a check at onboarding, followed by occasional refreshes. This static approach ignores how customer behavior and risk profiles change over time.

A client who once appeared low-risk may slowly build ties to higher-risk entities, or a small business may begin engaging in unusual cross-border flows. Without continuous monitoring of connections and context, these shifts go unnoticed until it’s too late.

The result is predictable. Compliance teams remain reactive, regulators remain unsatisfied with shallow audit trails, and bad actors continue to exploit the gaps that flat models can’t see.

How Graph Databases Change the Equation

Graph technology maps relationships. Every customer, transaction, account, and entity becomes part of a connected network that evolves as new data flows in. This shift from isolated rows to living networks gives compliance teams the ability to see beyond surface activity and uncover the patterns that matter most.

For example, fragmented customer identities can finally be unified. With entity resolution, duplicate or related records scattered across different business lines are linked, creating a single, consistent view of each customer and their connections. That unified view makes it much harder for criminals to hide behind duplicate or incomplete records.

Graph also excels at revealing hidden ownership structures. By traversing relationships and detecting patterns across accounts, businesses, and identities, it becomes clear when multiple entities ultimately tie back to the same beneficial owner, even if those links were deliberately buried in layers of intermediaries.

The same connected view applies to money movement. Instead of flagging a single suspicious transfer, graph exposes the entire transaction chain. It shows how funds move through multiple hops in a classic layering and integration strategy. Analysts gain the full picture, not just one piece of it.

Even customer due diligence evolves. Traditional KYC freezes at onboarding, but graph-powered models allow profiles to adapt as activity changes.

Risk ratings stay dynamic, ensuring that shifts in behavior, such as sudden international transfers or new high-risk associations, trigger timely reviews.

Graph also adds explainability to advanced technologies like generative AI. By anchoring AI insights in context-aware retrieval and clear relationship lineage, compliance teams can trust that recommendations are both actionable and auditable. This is, of course, a critical requirement in a regulated environment.

Real-World Results of Graph-Powered AML and KYC

At leading banks, the benefits of graph-powered AML and KYC are already clear. Compliance leaders gain auditability built in, with models that align directly with FinCEN, AML, and KYC regulations. This ensures every decision is transparent and defensible when regulators demand proof.

Analysts also face fewer false positives. Instead of being buried under a flood of threshold-based alerts, they can focus on the relationships that matter most, triaging alerts more quickly and accurately. The result is faster investigations and more time spent on true risk.

Just as important, these gains happen at enterprise scale. TigerGraph has been proven in production to handle more than a billion transactions per day, with queries returning in milliseconds. That level of performance makes real-time AML and KYC not only possible, but practical for the world’s largest banks. And this capacity is well-timed, as the pressure on compliance teams isn’t slowing down.

Regulators expect more transparency, customers demand smoother onboarding, and criminals continue to innovate. Flat systems can’t meet these rising demands. Graph can.

Reach out for more info on how to use graph to strengthen AML/KYC compliance by embedding context, relationships, and adaptability into every compliance decision. And experience graph analytics in minutes by launching your free TigerGraph instance at tgcloud.io.