How Graph-Powered AML Systems Catch What Traditional Rules Miss?

Financial crime evolves faster than compliance systems. Static AML monitoring tools built on decades-old frameworks struggle to interpret modern, cross-border transaction behavior. They rely on rules that look for surface-level anomalies like amount, frequency, or geography.

But they don’t understand intent. They can’t see relationships. And that’s where money moves unnoticed.

False positives pile up and risk hides in connections that relational databases can’t model. Compliance teams lose time reviewing noise instead of real threats.

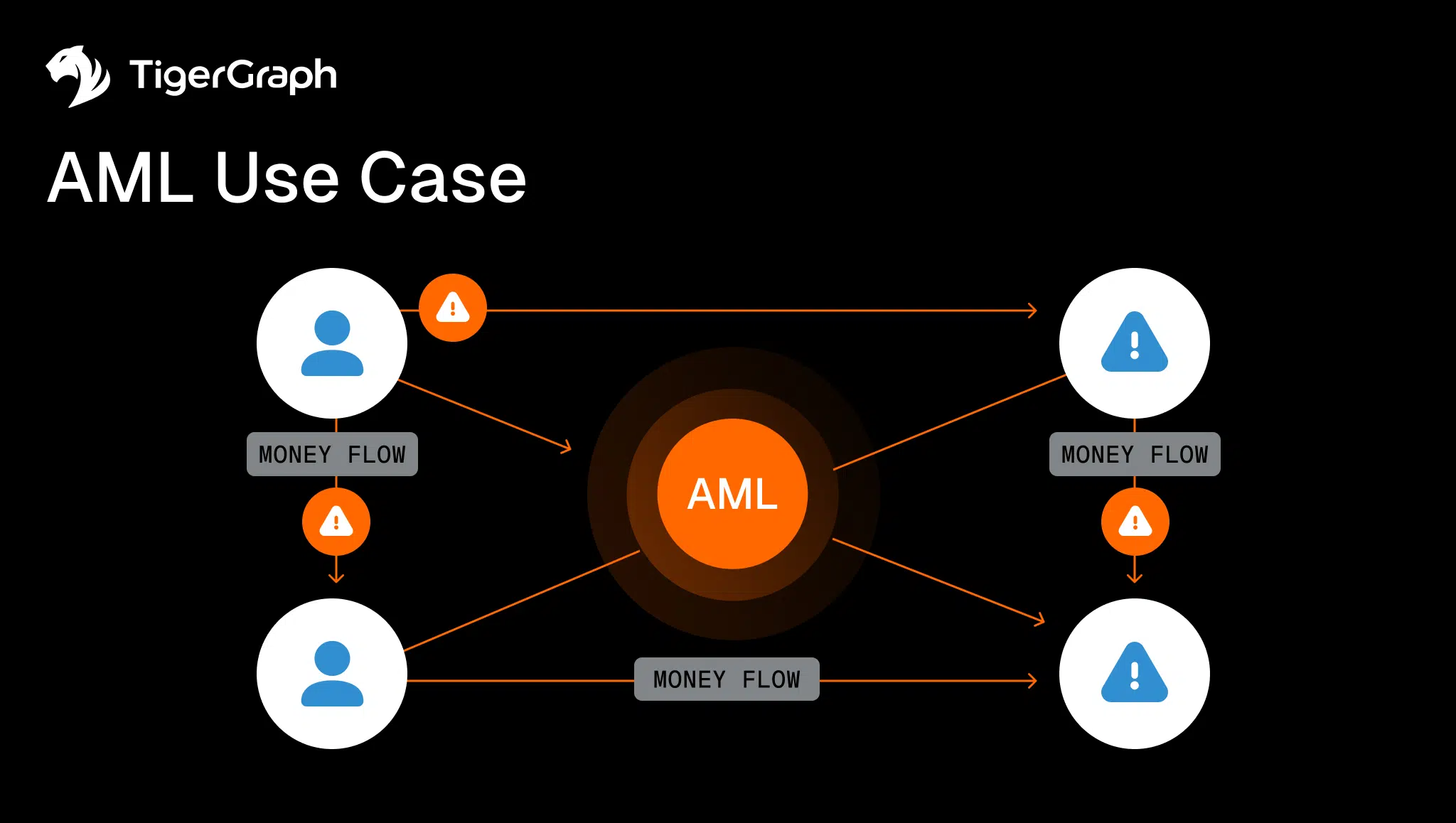

That’s why modern AML transaction monitoring use cases now depend on connected intelligence.

Graph technology turns fragmented data into dynamic context that links people, accounts, devices, and geographies into one living picture of financial activity. It doesn’t just detect anomalies. It explains them.

Context is how financial institutions stay compliant and ahead.

How to Understand AML Transaction Monitoring Rules?

In anti-money laundering, transaction monitoring rules define the logic used to flag suspicious behavior. They’re the backbone of compliance programs—the thresholds, velocity checks, and patterns that indicate potential laundering. Common triggers include:

- Unusual transfers between related accounts.

- Rapid movement of funds through multiple intermediaries.

- Transactions repeatedly just below the reporting limit.

- Exposure to high-risk jurisdictions.

Each rule provides signal, but isolated signals are incomplete.

For instance, a single transaction may appear routine. Yet when connected to dozens of others sharing similar metadata, like common phone numbers, IPs, or addresses—a hidden network emerges.

A graph-based AML platform captures those relationships in real time. It creates a contextual map that reveals who’s connected, how funds move, and where anomalies cluster.

The result is faster detection, fewer false positives, and explainable reasoning auditors can trust.

What are Common AML Transaction Monitoring Scenarios?

Compliance teams apply structured AML monitoring scenarios to simulate real-world laundering typologies. Traditional systems test these in silos. Graph analytics tests them together, because criminals don’t act in isolation.

- Rapid movement of funds is seen in multiple deposits, withdrawals, or cross-border transfers in short succession.

- Circular transactions show funds cycling between entities to simulate legitimate business activity.

- Structuring (Smurfing) is indicated by bad actors splitting large sums into smaller, unreported amounts to avoid scrutiny.

- Dormant-to-active accounts means there are sudden spikes in activity after months of inactivity.

- Third-party transfers show up as payments between unrelated senders and recipients with no clear commercial relationship.

- High-risk geographies create exposure to sanctioned regions or tax havens through indirect routing.

Traditional tools look for any one of these. Graph systems find when several overlap, revealing intent through patterns that span time, accounts, and borders.

Graph analytics transforms detection from static event analysis into dynamic behavioral understanding.

AML Rules in Action: Real-World Examples

| Scenario | Rule Type | Graph Insight |

|---|---|---|

| Rapid movement of funds | Frequency threshold | Detects coordinated transfers across multiple entities |

| Structuring | Transaction value limit | Identifies distributed deposits under shared ownership |

| Geographic risk | Country rule | Uncovers indirect routing through intermediary banks |

| Collusion | Shared identifiers | Maps hidden ties among merchants, brokers, or mules |

| Dormant-to-active accounts | Velocity anomaly | Links reactivated accounts to ongoing laundering rings |

Traditional SQL-based models evaluate each rule separately. Graph databases evaluate them together, following paths across people, systems, and transactions in milliseconds.

This connected reasoning converts suspicion into understanding. It shows not only what is happening, but why.

Why Graph Databases Strengthen AML Monitoring?

The future of AML lies in context. Graph databases are built for it. They model relationships directly, storing both entities and edges as first-class data citizens. That difference changes everything.

Legacy AML systems require complex joins across flat tables just to simulate connectivity. Each join slows performance and increases noise. Graph-native AML systems operate differently: they traverse relationships instantly, finding hidden pathways no rule-based engine could anticipate.

The advantages are measurable:

- Contextual detection: Discover suspicious clusters in real time.

- Fewer false positives: Understand relationships before escalating cases.

- Explainable AI: Trace alerts through transparent, auditable paths.

- Continuous learning: Adapt as typologies shift or new entities appear.

- Unified view: Integrate KYC, onboarding, sanctions, and payments data in one connected model.

With graph analytics, investigators don’t just respond to alerts—they interpret networks. They see cause, effect, and risk in one motion.

What Are the Most Common AML Use Cases Across Financial Institutions?

The same connected intelligence applies across every corner of finance. From retail banking to wealth management, graph-powered AML monitoring turns fragmented detection into a unified understanding of risk.

Retail Banking:

Retail banks process millions of transactions daily, many across shared accounts, devices, or phone numbers. Graph analytics helps compliance teams detect layering and structuring that spans multiple customer profiles. By linking identifiers across accounts, institutions can expose coordinated behavior that single-rule systems would miss, reducing false positives and improving investigator accuracy.

Corporate Banking:

Corporate networks conceal shell entities that transact heavily with overlapping vendors or offshore intermediaries. But graph-based AML models reveal these ownership and funding relationships. It maps directors, suppliers, and payment routes, so banks can pinpoint circular money flows and isolate potential trade-based money laundering (TBML) operations before they escalate.

Fintech and Payments:

Launderers exploit speed and anonymity of digital platforms through micro-laundering and rapid fund movement. Graph analytics correlates peer-to-peer transactions, wallet IDs, and device signatures in real time, creating context that helps fintech firms identify suspicious clusters. And it works even when individual transfers appear benign. This strengthens both compliance and customer trust.

Insurance:

Fraud and laundering can cross-pollinate in insurance claims, particularly when policyholders, brokers, and repair shops collaborate to hide illicit payments. Graph models expose collusion networks that traditional systems overlook by connecting entities through shared addresses, phone numbers, or payout destinations. This gives investigators a full relational view of how fraudulent claims are born across policies and providers.

Wealth Management:

High-net-worth clients often hold assets through layered trusts, intermediaries, and investment vehicles. A graph-based approach links beneficial ownership structures to transactional activity, creating visibility across jurisdictions. This clarity supports both AML compliance and transparency requirements under global regulations.

Correspondent Banking:

Cross-border transactions come with unique challenges when monitoring nested accounts and proxy institutions. Graph analytics helps trace flows across correspondent relationships, revealing intermediary banks and hidden beneficiaries. This connected view enables compliance teams to detect high-risk corridors and document every path of funds for regulatory audits.

Each domain benefits from the same advantage—clarity. When relationships are visible, patterns of abuse no longer hide in the gaps between systems. Graph analytics transforms AML from reactive compliance to proactive intelligence, empowering institutions to understand risk, not just report it.

Integrating Graphs into AML Operations

Graphs don’t replace existing AML systems—they elevate them. Rule engines still trigger alerts. Graph analytics gives those alerts meaning. It connects entities across institutions, channels, and jurisdictions.

When a rule flags “rapid movement of funds,” graph traversal shows the full pattern, revealing who initiated it, how accounts relate, and where similar behavior repeats. Investigators no longer start from scratch. They see the network immediately.

This context-first approach shortens investigation time dramatically. It also eliminates repetitive false positives—helping teams focus on real risk.

How Graph Technology Improves AML Efficiency?

| Challenge | Traditional AML System | Graph-Powered AML System |

|---|---|---|

| Alert volume | High false positives | Contextual clustering cuts noise |

| Data silos | Fragmented sources | Unified entity resolution |

| Investigation time | Hours per case | Minutes via real-time graph traversal |

| Explainability | Manual tracebacks | Visual, regulator-ready audit trails |

Graph analytics transforms AML investigation from a rule-based task into a reasoning-driven process. Analysts see entire risk ecosystems instead of isolated records.

Regulatory and Business Impact

Compliance is about more than catching bad actors. It’s about proving diligence. Graph databases support both. They make risk decisions explainable, auditable, and fast.

Institutions deploying graph-powered AML systems have reported significant operational gains, including measurable reductions in false positives, faster case resolution, and improved collaboration across compliance, fraud, and cybersecurity teams.

Explainability is critical under regulatory frameworks. Graph-based transparency meets that requirement, ensuring every conclusion can be justified step by step.

How Does TigerGraph Enable AML?

TigerGraph provides the foundation for enterprise-scale AML. Its native parallel graph engine handles billions of transactions with sub-second speed, linking every account, entity, and event into one connected network.

Financial institutions use TigerGraph to unify AML, sanctions, and fraud detection pipelines. It delivers adaptive transaction monitoring rules that evolve alongside criminal typologies, not behind them.

Our advantage lies in context, turning static compliance systems into intelligent risk networks, and helping institutions detect, explain, and act faster than ever.

Summary

Money laundering thrives in the gaps between systems. Graph analytics closes those gaps. It connects data across silos, creating context that reveals intent.

From rapid movement of funds to collusive transaction patterns, graph-powered AML monitoring uncovers hidden links and strengthens compliance outcomes. It reduces false positives, accelerates investigations, and satisfies regulatory scrutiny with explainable precision.

TigerGraph enables that transformation. It gives financial institutions a connected, scalable foundation to detect financial crime with clarity, confidence, and speed. Reach out today to learn more and see graph technology in action.