Artificial Intelligence at Mastercard

- Blog >

- Artificial Intelligence at Mastercard

This is an abbreviated version of a presentation by Rohit Chauhan, Executive Vice President, AI and Security Solutions, at Mastercard, during the Fall 2021 Graph + AI Fall Summit conference.

Rohit Chauhan, Executive Vice President | Artificial Intelligence, Mastercard

In this presentation today I’d like to walk you through the AI journey at MasterCard, including looking at what we have done and what we aspire to do with this major initiative within the company.

Before getting into my presentation, however, I do want to mention that I strongly believe that the history books will describe this era we’re living through as being one with the most dramatic improvements in the productivity of mankind. This is bigger than computers; this is bigger than the internet — the AI revolution will be much bigger than anything that we’ve seen in the past.

So, with that as a backdrop, let me describe a discussion that I had with our CEO a few years back. He told me, “I want AI in the fabric of MasterCard. I want it to be in HR; I want it to be in Legal; I want it to be everywhere.” And, with that, I started this AI journey.

Our CEO has the aspiration for MasterCard to become an AI powerhouse. And that is a really big goal, especially when I didn’t know exactly what we were getting into. But over time, we distilled it down to five pillars:

- AI-powered Products -First, we want to ensure that AI powers all our products and services.

- AI-powered Customers – Second, we want to drive towards AI-powered customers – not only do we want to take our own journey, we want to make sure that our customers are also on the journey.

- AI-powered Mastercard – Thirdly, we want to ingrain AI into the fabric of MasterCard, into every function within MasterCard.

- AI for Good – Next, we want to make sure that we do AI for good, for the betterment of society.

- Ethical AI – And the last one is to ensure we apply AI in ethical ways. And that is a really, really important topic because, before passing the decision-making to a machine, you need to make sure that the machines are actually reflecting your core values and your business effects rather than trying to optimize just for profitability, or just a whole bunch of other things.

So, let’s look at a couple of these pillars now.

AI-powered Products

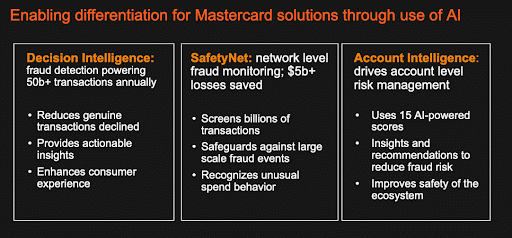

Decision Intelligence

So, consider this: we have two and a half billion payment cards that get accepted at 70 million merchant locations in 190 countries and territories across the globe. And, on a typical day, we see over a billion transactions. And we get 30 milliseconds to score the transaction and make a decision about the legality of the transaction. Is there something about this transaction that has to be flagged and has to be rejected because it looked fraudulent?

AI is being applied to assist with Decision Intelligence, a solution that has been the core to MasterCard, safety and security. We actually score every transaction passing through our network.

SafetyNet

SafetyNet is another example. Here, we’re looking at the marginal cost of a fraudulent transaction. Think about this: fraudsters are sitting in a basement somewhere and sending out zillions of these fraudulent transactions and, for them to win, they just need one transaction to get through. So just imagine that we are on constant defense, it’s like an asymmetric game, we only play defense, they only play offense. To win, we have to stop every possible attack that’s coming in. To win, they just need one, one production to get through.

Account Intelligence

Account intelligence is another set of scores that we have produced that we actually embed in the message, where we tell the banks and the merchants more about a particular cardholder.

For example, we know that people who tap cards at a point of sale are less likely to be fraudsters than those that are swiping cards or using them on the internet. However, a wide segment of the population still doesn’t tap because they’re not familiar with doing so yet. And we use Account Intelligence to encourage merchants to consider giving incentives to consumers to tap, because, in the long run, it will protect them better.

Now, let’s shift gears and look at how we’re applying AI in an ethical way at Mastercard.

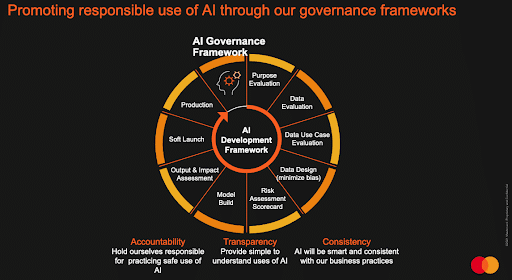

Ethical AI

Promoting responsible use of AI through governance frameworks is very important. Any model that goes into production goes through a whole bunch of reviews, not just by the team that develops it, but by people who are outside the business, including privacy individuals, our chief data officer’s staff, and a whole bunch of other committee members, to ensure that the model is robust.

Now let’s get a little more technical.

AI is an incredible tool that needs to be applied intelligently — I tell people that no matter how much AI you put onto a candle, it will never turn into a light bulb! You have to look at the problems and think about what you are trying to solve, rather than taking an existing problem and putting AI on it to no long-term effect. To find a better solution, you have to understand the problem fundamentally.

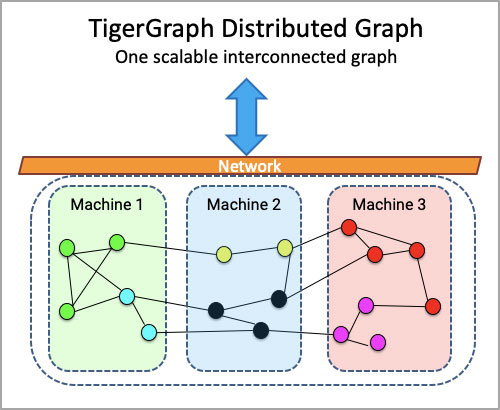

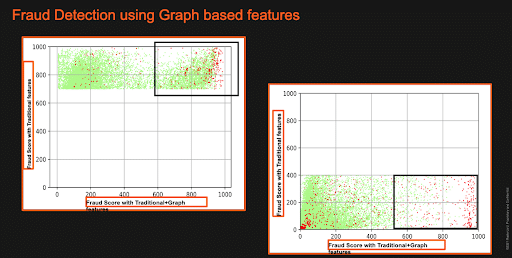

So likewise, although we’ve been on an AI journey for 10 years in the fraud space, it was only very recently that we started reframing the data sets that we collect as graphs.

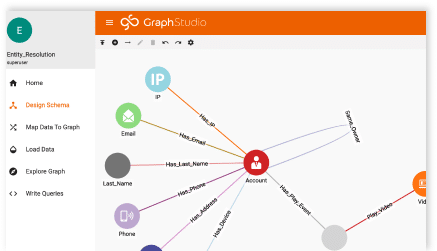

What we did was to represent transaction data as a graph and, in the graph, consumers become nodes, and merchants become nodes – and every transaction is an edge that connects the consumer and the merchant.

Based on this, we created thousands of additional features that were never available in the past.

What has been the result? Well, you can see here (in figure 3) what the credit model looks like:

- The y-axis shows fraud scores that were calculated only using traditional features;

- The x-axis shows fraud scores that combine traditional features with graph-generated features.

We see, clearly in fact, that we get better separations between the good and the bad when we use graph features on top of traditional features.

Where a model using only traditional features scored the risk of fraud highly (chart on the left), we were able to separate 60% of the false negatives and false positives.

And, in the scenario where the scores are low when calculated using only traditional features (chart on the right), we were, again, able to obtain better separation—and a higher confidence that we’re getting more accurate results with fewer false positives.

So, to wrap up, I cannot thank companies like TigerGraph enough for making these tools available. In the past, the data economy was only monopolized by like five digital giants in the world, but with companies like TigerGraph and a bunch of other companies, every company can now actually play in the data economy. We all have the tools that were earlier confined only to the digital giants.

Click here to view the full session.

Spring 2022 Graph + AI Summit Details Coming Soon

Planning is currently underway for the Spring 2022 Graph + AI Summit. This global virtual conference will bring together our community to advance graph analytics, artificial intelligence, and machine learning knowledge.

Conference details and registration information will be coming soon!